Fill Your I 864A Affidavit Of Support Form

The I-864A Affidavit of Support form is an essential document within the immigration process, serving as a contract between a sponsor in the United States and a household member. This form, officially known as the Contract Between Sponsor and Household Member, is utilized by U.S. Citizenship and Immigration Services (USCIS), a component of the Department of Homeland Security. Its main purpose is to ensure that intending immigrants have adequate financial support and will not rely on public benefits. This document requires detailed information about the household member's relationship to the sponsor, employment and income details, and federal income tax information and assets. It also involves declarations and certifications by both the sponsor and the household member, highlighting their promises and responsibilities towards the financial support of the intending immigrant. The form not only establishes the household member's commitment to assist the sponsor in supporting the immigrant but also outlines the consequences of failing to adhere to the agreement, making it a crucial piece of the immigration puzzle. With an expiration date of 12/31/2023, the current version emphasizes the importance of accurate and truthful submissions, reinforing the legal responsibilities that come with the sponsorship of immigrants to the United States.

Document Sample

Contract Between Sponsor and Household Member |

USCIS |

Department of Homeland Security |

Form |

OMB No. |

|

U.S. Citizenship and Immigration Services |

Expires 12/31/2023 |

For Government Use Only

This Form

IS the intending immigrant

IS NOT the |

Reviewed By: |

|

intending |

Location: |

Date (mm/dd/yyyy): |

immigrant |

To be completed by an |

Select this box if |

|

Attorney State Bar Number |

|

|

Attorney or Accredited Representative |

|

|||||||||||

Form |

|

(if applicable) |

|

|

USCIS Online Account Number (if any) |

|

||||||||||||

attorney or accredited |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

representative (if any). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

►START HERE - Type or print in black ink.

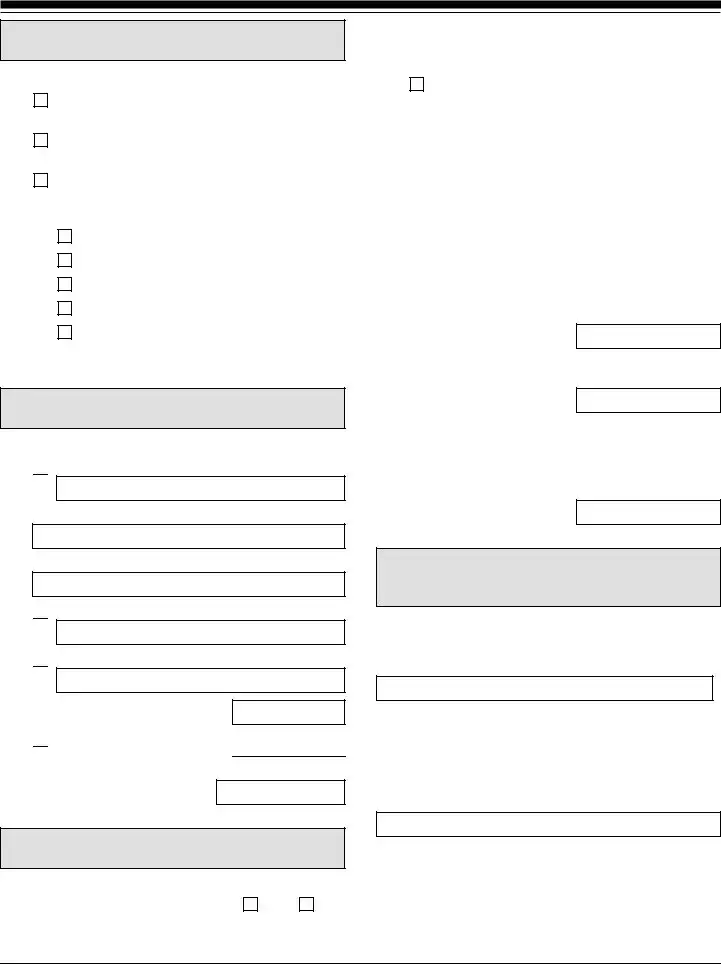

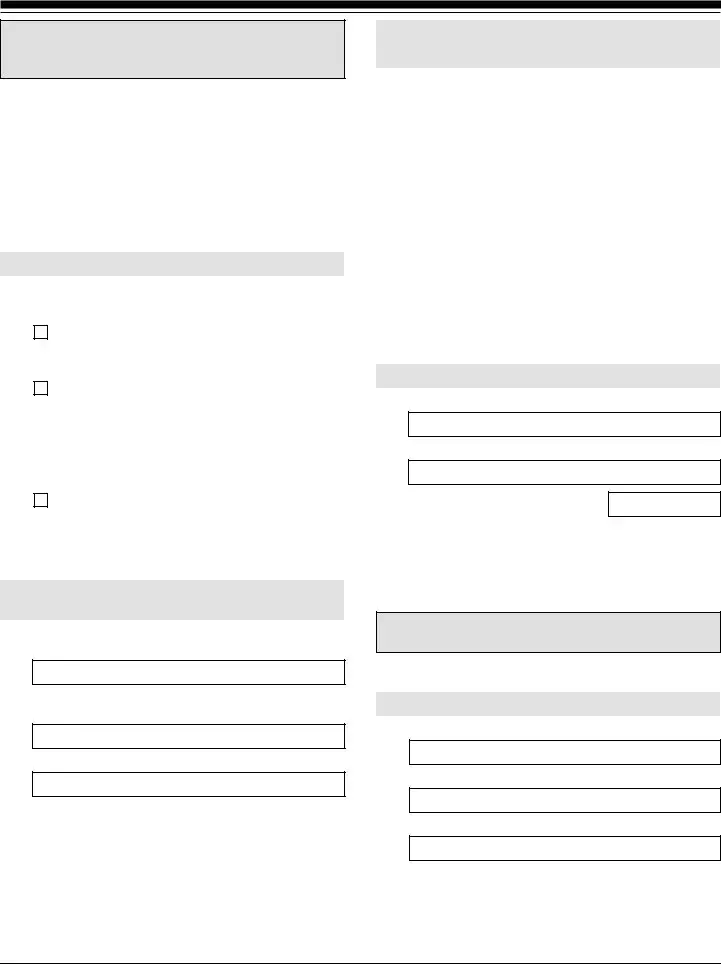

Part 1. Information About You (the Household Member)

Physical Address

4.a. Street Number

and Name

Full Name

1.a. Family Name

(Last Name)

1.b. Given Name

(First Name)

1.c. Middle Name

Mailing Address |

(USPS ZIP Code Lookup) |

2.a. In Care Of Name

4.b.  Apt.

Apt.

4.c. City or Town 4.d. State

4.c. City or Town 4.d. State

4.f. Province

4.g. Postal Code

4.h. Country

Ste.

Flr.

Flr.

4.e. ZIP Code

2.b. Street Number

and Name

Other Information

2.c.  Apt.

Apt.

2.d. City or Town 2.e. State

2.d. City or Town 2.e. State

2.g. Province

2.h. Postal Code

2.i. Country

Ste.

Flr.

Flr.

2.f. ZIP Code

5.Date of Birth (mm/dd/yyyy)

Place of Birth 6.a. City or Town

6.b. State or Province

6.c. Country

3.Is your current mailing address the same as your physical

address? |

Yes |

No |

|

If you answered "No" to Item Number 3., provide your physical address.

7.U.S. Social Security Number (if any)

►

8.USCIS Online Account Number (if any)

►

Form |

Page 1 of 8 |

Part 2. Your (the Household Member's) Relationship to the Sponsor

Select Item Number 1.a., 1.b., or 1.c.

1.a. |

I am the intending immigrant and also the sponsor's |

|

|

spouse. |

|

1.b. |

I am the intending immigrant and also a member of |

|

|

the sponsor's household. |

|

1.c. |

I am not the intending immigrant. I am the sponsor's |

|

|

household member. I am related to the sponsor as |

|

|

his/her: |

|

|

|

Spouse |

|

|

Son or Daughter (at least 18 years of age) |

|

|

Parent |

|

|

Brother or Sister |

|

|

Other Dependent (Specify) |

|

|

|

Part 3. Your (the Household Member's) Employment and Income

I am currently:

1.

Employed as a/an

Employed as a/an

2.Name of Employer Number 1

3.Name of Employer Number 2 (if applicable)

4.

Self employed as a/an

Self employed as a/an

5.

Retired from (Company Name)

Retired from (Company Name)

Since (mm/dd/yyyy)

6.

Unemployed since (mm/dd/yyyy)

Unemployed since (mm/dd/yyyy)

7.My current individual annual income is:

$

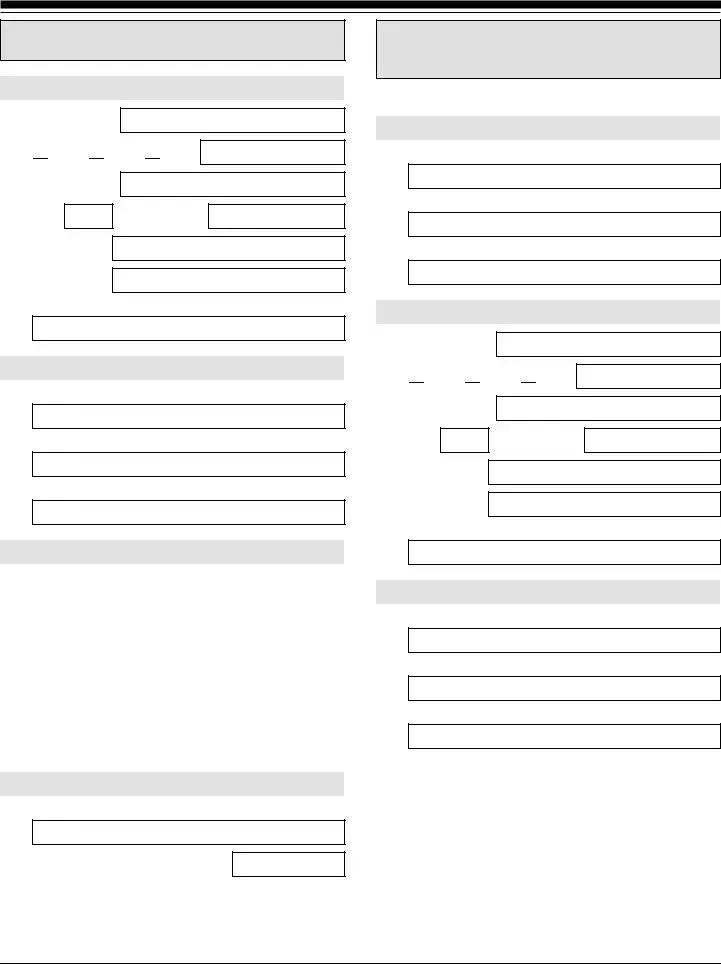

Part 4. Your (the Household Member's) Federal Income Tax Information and Assets

1.a. Have you filed a Federal income tax return for each of the

three most recent tax years? |

Yes |

No |

|

|

NOTE: You MUST attach a photocopy or transcript of |

|

your Federal income tax return for only the most recent |

|

tax year. |

1.b. |

(Optional) I have attached photocopies or transcripts |

|

of my Federal income tax returns for my second and |

|

third most recent tax years. |

My total income (adjusted gross income on IRS Form 1040EZ) as reported on my Federal income tax returns for the most recent three years was:

|

|

Tax Year |

|

Total Income |

2.a. |

Most Recent |

|

$ |

|

2.b. |

2nd Most Recent |

|

$ |

|

|

|

|||

2.c. |

3rd Most Recent |

|

$ |

|

|

|

|||

|

|

|

|

|

My assets (complete only if necessary).

3.a. Enter the balance of all cash, savings, and checking

accounts.$

3.b. Enter the net cash value of

$

3.c. Enter the cash value of all stocks, bonds, certificates of deposit, and other assets not listed on Item Numbers 3.a.

or 3.b. |

$ |

|

|

||

|

|

|

|

|

|

3.d. Add together Item Numbers 3.a., 3.b., and 3.c. and enter |

||

the number here. |

$ |

|

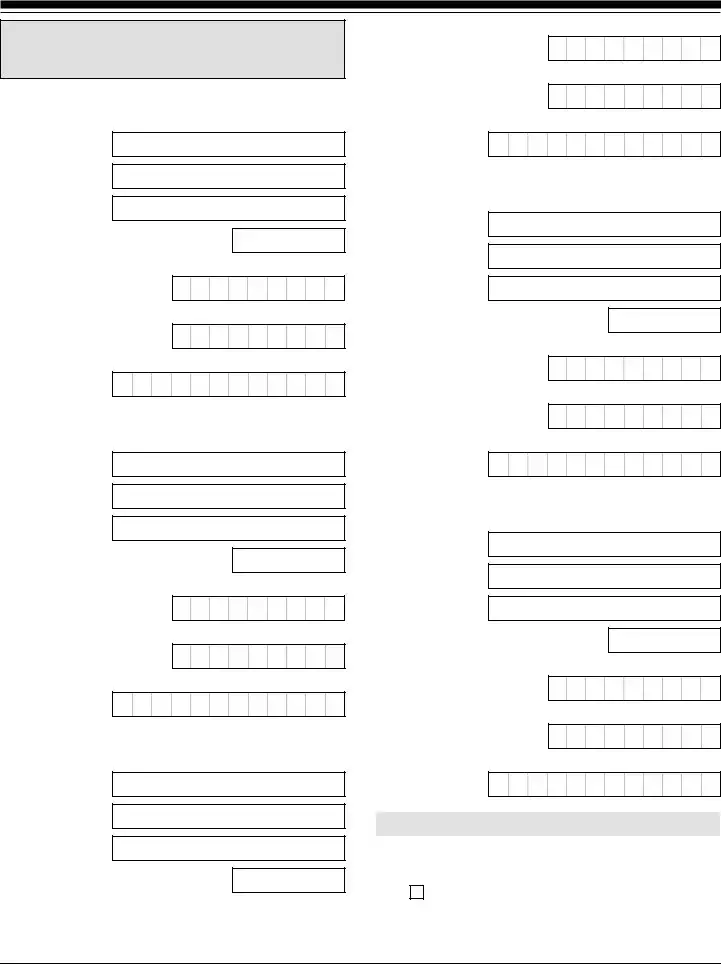

Part 5. Sponsor's Promise, Statement, Contact

Information, Declaration, Certification, and

Signature

NOTE: Read the Penalties section of the Form

I, THE SPONSOR,

,

(Print Name)

in consideration of the household member's promise to support the following intending immigrants and to be jointly and severally liable for any obligations I incur under the affidavit of support, promise to complete and file an affidavit of support on behalf of the following named intending immigrants.

(Indicate Number)

Form |

Page 2 of 8 |

Part 5. Sponsor's Promise, Statement, Contact

Information, Declaration, Certification, and

Signature (continued)

Intending Immigrant Number 1

Name

1.a. Family Name

(Last Name)

1.b. Given Name

(First Name)

1.c. Middle Name

2. Date of Birth (mm/dd/yyyy)

3.Alien Registration Number

► A-

4.U.S. Social Security Number (if any)

►

5.USCIS Online Account Number (if any)

►

Intending Immigrant Number 2

Name

6.a. Family Name

(Last Name)

6.b. Given Name

(First Name)

6.c. Middle Name

7. Date of Birth (mm/dd/yyyy)

8.Alien Registration Number

► A-

9.U.S. Social Security Number (if any)

►

10.USCIS Online Account Number (if any)

►

Intending Immigrant Number 3

Name

11.a. Family Name

(Last Name)

11.b. Given Name

(First Name)

11.c. Middle Name

12. Date of Birth (mm/dd/yyyy)

13.Alien Registration Number

► A-

14.U.S. Social Security Number (if any)

►

15.USCIS Online Account Number (if any)

►

Intending Immigrant Number 4

Name

16.a. Family Name

(Last Name)

16.b. Given Name

(First Name)

16.c. Middle Name

17. Date of Birth (mm/dd/yyyy)

18.Alien Registration Number

► A-

19.U.S. Social Security Number (if any)

►

20.USCIS Online Account Number (if any)

►

Intending Immigrant Number 5

Name

21.a. Family Name

(Last Name)

21.b. Given Name

(First Name)

21.c. Middle Name

22. Date of Birth (mm/dd/yyyy)

23.Alien Registration Number

► A-

24.U.S. Social Security Number (if any)

►

25.USCIS Online Account Number (if any)

►

Sponsor's Statement

NOTE: Select the box for either Item Number 26.a. or 26.b. If applicable, select the box for Item Number 27.

26.a. I can read and understand English, and I have read and understand every question and instruction on this contract and my answer to every question.

Form |

Page 3 of 8 |

Part 5. Sponsor's Promise, Statement, Contact

Information, Declaration, Certification, and

Signature (continued)

26.b. The interpreter named in Part 7. read to me every question and instruction on this contract and my answer to every question in

,

|

a language in which I am fluent, and I understood |

|

everything. |

27. |

At my request, the preparer named in Part 8., |

,

prepared this contract for me based only upon information I provided or authorized.

Sponsor's Contact Information

28.Sponsor's Daytime Telephone Number

29.Sponsor's Mobile Telephone Number (if any)

30.Sponsor's Email Address (if any)

Sponsor's Declaration and Certification

Copies of any documents I have submitted are exact photocopies of unaltered, original documents, and I understand that U.S. Citizenship and Immigration Services (USCIS) or the U.S. Department of State (DOS) may require that I submit original documents to USCIS or DOS at a later date. Furthermore, I authorize the release of any information from any and all of my records that USCIS or DOS may need to determine my eligibility for the immigration benefit that I seek.

I furthermore authorize release of information contained in this contract, in supporting documents, and in my USCIS or DOS records, to other entities and persons where necessary for the administration and enforcement of U.S. immigration law.

I certify, under penalty of perjury, that all of the information in my contract and any document submitted with it were provided or authorized by me, that I reviewed and understand all of the information contained in, and submitted with, my contract and that all of this information is complete, true, and correct.

Sponsor's Signature

31.a. Sponsor's Signature

31.b. Date of Signature (mm/dd/yyyy)

NOTE TO ALL SPONSORS: If you do not completely fill out this contract or fail to submit required documents listed in the Instructions, USCIS may deny your contract.

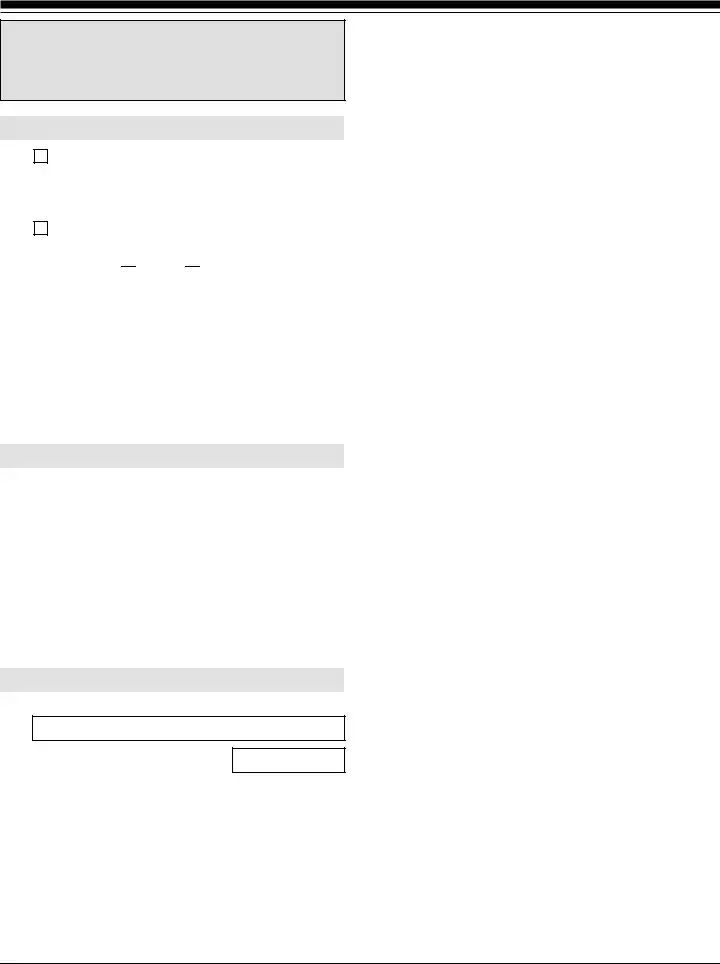

Part 6. Your (the Household Member's) Promise,

Statement, Contact Information, Declaration,

Certification, and Signature

NOTE: Read the Penalties section of the Form

I, THE HOUSEHOLD MEMBER,

,

(Print Name)

in consideration of the sponsor's promise to complete and file an affidavit of support on behalf of the above named intending immigrants.

(Print number of intending immigrants noted in Part 5.

Sponsor's Promise, Statement, Contact Information, Declaration, Certification and Signature.)

A.Promise to provide any and all financial support necessary to assist the sponsor in maintaining the sponsored immigrants at or above the minimum income provided for in the Immigration and Naturalization Act (INA) section 213A(a)(1)(A) (not less than 125 percent of the Federal Poverty Guidelines) during the period in which the affidavit of support is enforceable;

B.Agree to be jointly and severally liable for payment of any and all obligations owed by the sponsor under the affidavit of support to the sponsored immigrants, to any agency of the Federal Government, to any agency of a state or local government, or to any other private entity that provides

C.Certify under penalty under the laws of the United States that the Federal income tax returns submitted in support of the contract are true copies or unaltered tax transcripts filed with the Internal Revenue Service;

D.Consideration where the household member is also the sponsored immigrant: I understand that if I am the sponsored immigrant and a member of the sponsor's household that this promise relates only to my promise to be jointly and severally liable for any obligation owed by the sponsor under the affidavit of support to any of my dependents, to any agency of the Federal Government, to any agency of a state or local government, or to any other private entity that provides

Form |

Page 4 of 8 |

Part 6. Your (the Household Member's) Promise,

Statement, Contact Information, Declaration,

Certification, and Signature (continued)

E.I understand that, if I am related to the sponsored immigrant or the sponsor by marriage, the termination of the marriage (by divorce, dissolution, annulment, or other legal process) will not relieve me of my obligations under this Form

F.I authorize the Social Security Administration to release information about me in its records to the Department of State and U.S. Citizenship and Immigration Services (USCIS).

Your (the Household Member's) Statement

NOTE: Select the box for either Item Number 1.a. or 1.b. If applicable, select the box for Item Number 2.

1.a. |

I can read and understand English, and I have read |

|

|

and understand every question and instruction on this |

|

|

contract and my answer to every question. |

|

1.b. |

The interpreter named in Part 7. read to me every |

|

|

question and instruction on this contract and my |

|

|

answer to every question in |

|

|

|

, |

|

a language in which I am fluent, and I understood |

|

|

everything. |

|

2. |

At my request, the preparer named in Part 8., |

|

|

|

, |

|

prepared this contract for me based only upon |

|

|

information I provided or authorized. |

|

Your (the Household Member's) Contact Information

3.Your (the Household Member's) Daytime Telephone Number

4.Your (the Household Member's) Mobile Telephone Number (if any)

5.Your (the Household Member's) Email Address (if any)

Your (the Household Member's) Declaration and Certification

Copies of any documents I have submitted are exact photocopies of unaltered, original documents, and I understand that USCIS or DOS may require that I submit original documents to USCIS or DOS at a later date. Furthermore, I authorize the release of any information from any and all of my records that USCIS or DOS may need to determine my eligibility for the immigration benefit that I seek.

I furthermore authorize release of information contained in this contract, in supporting documents, and in my USCIS or DOS records, to other entities and persons where necessary for the administration and enforcement of U.S. immigration law.

I certify, under penalty of perjury, that all of the information in my contract and any document submitted with it were provided or authorized by me, that I reviewed and understand all of the information contained in, and submitted with, my contract and that all of this information is complete, true, and correct.

Your (the Household Member's) Signature

6.a. Your (the Household Member's) Printed Name

6.b. Your (the Household Member's) Signature

6.c. Date of Signature (mm/dd/yyyy)

NOTE TO ALL HOUSEHOLD MEMBERS: If you do not completely fill out this contract or fail to submit required documents listed in the Instructions, USCIS may deny your contract.

Part 7. Interpreter's Contact Information, Certification, and Signature

Provide the following information about the interpreter.

Interpreter's Full Name

1.a. Interpreter's Family Name (Last Name)

1.b. Interpreter's Given Name (First Name)

2.Interpreter's Business or Organization Name (if any)

Form |

Page 5 of 8 |

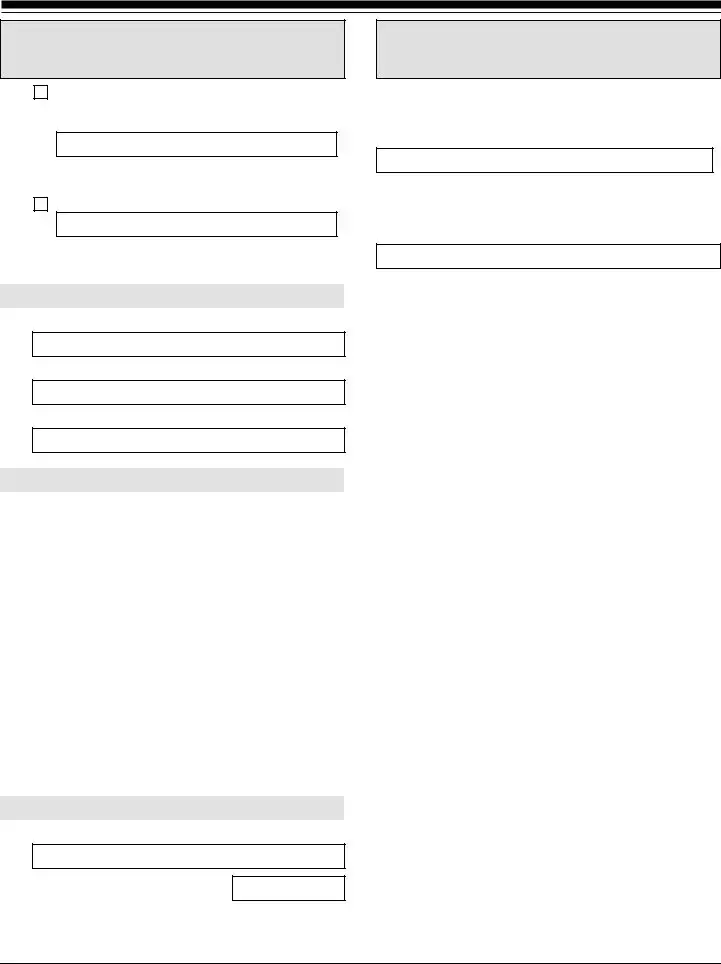

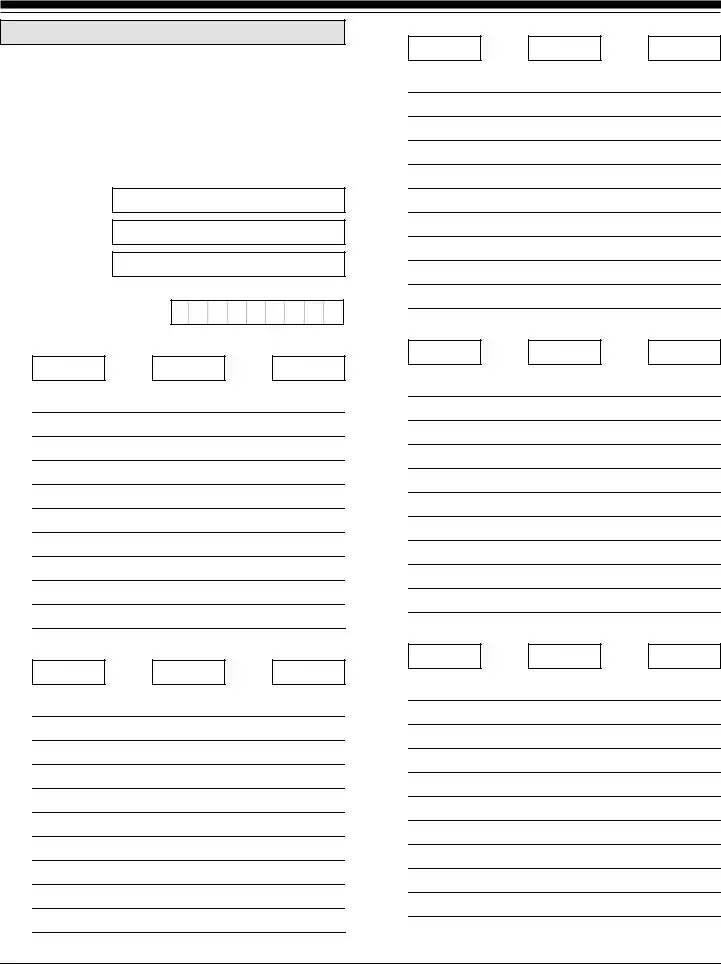

Part 7. Interpreter's Contact Information, Certification, and Signature (continued)

Interpreter's Mailing Address

Part 8. Contact Information, Declaration, and Signature of the Person Preparing this Contract, if Other Than the Sponsor or Household Member

Provide the following information about the preparer.

3.a. Street Number

and Name

3.b.

Apt.

Apt.

3.c. City or Town 3.d. State

3.c. City or Town 3.d. State

3.f. Province

3.g. Postal Code

3.h. Country

Ste.

Flr.

Flr.

3.e. ZIP Code

Preparer's Full Name

1.a. Preparer's Family Name (Last Name)

1.b. Preparer's Given Name (First Name)

2.Preparer's Business or Organization Name (if any)

Preparer's Mailing Address

3.a. Street Number

and Name

Interpreter's Contact Information

4.Interpreter's Daytime Telephone Number

5.Interpreter's Mobile Telephone Number (if any)

6.Interpreter's Email Address (if any)

Interpreter's Certification

3.b.

Apt.

Apt.

3.c. City or Town 3.d. State

3.c. City or Town 3.d. State

3.f. Province

3.g. Postal Code

3.h. Country

Ste.

Flr.

Flr.

3.e. ZIP Code

I certify, under penalty of perjury, that: |

|

|

I am fluent in English and |

|

, |

which is the same language specified in Part 5., Item |

|

|

Number 26.b. or Part 6., Item Number 1.b., and I have read |

|

|

to this sponsor or household member in the identified language |

|

|

every question and instruction on this contract and his or her |

|

|

answer to every question. The sponsor or household member |

|

|

informed me that he or she understands every instruction, |

|

|

question, and answer on the contract, including the Sponsor's |

|

|

or Household Member's Declaration and Certification, and |

|

|

has verified the accuracy of every answer. |

|

|

Interpreter's Signature

7.a. Interpreter's Signature

7.b. Date of Signature (mm/dd/yyyy)

Preparer's Contact Information

4.Preparer's Daytime Telephone Number

5.Preparer's Mobile Telephone Number (if any)

6.Preparer's Email Address (if any)

Form |

Page 6 of 8 |

Part 8. Contact Information, Declaration, and Signature of the Person Preparing this Contract, if Other Than the Sponsor or Household Member

(continued)

Preparer's Statement

7.a.

7.b.

I am not an attorney or accredited representative but have prepared this contract on behalf of the sponsor and household member and with the sponsor's or household member's consent.

I am an attorney or accredited representative and my representation of the sponsor and household member in this case

extends

extends

does not extend beyond

does not extend beyond

the preparation of this contract.

NOTE: If you are an attorney or accredited representative, you may be obliged to submit a completed Form

Preparer's Certification

By my signature, I certify, under penalty of perjury, that I prepared this contract at the request of the sponsor and household member. The sponsor and household member then reviewed this completed contract and informed me that he or she understands all of the information contained in, and submitted with, his or her contract, including the Sponsor's or Household Member's Declaration and Certification, and that all of this information is complete, true, and correct. I completed this contract based only on information that the sponsor and household member provided to me or authorized me to obtain or use.

Preparer's Signature

8.a. Preparer's Signature

8.b. Date of Signature (mm/dd/yyyy)

Form |

Page 7 of 8 |

Part 9. Additional Information

If you need extra space to provide any additional information within this contract, use the space below. If you need more space than what is provided, you may make copies of this page to complete and file with this contract or attach a separate sheet of paper. Type or print your name and

1.a. Family Name (Last Name)

1.b. Given Name (First Name)

1.c. Middle Name

2.

► A-

3.a. Page Number 3.b. Part Number 3.c. Item Number

3.d.

4.a. Page Number 4.b. Part Number 4.c. Item Number

4.d.

5.a. Page Number 5.b. Part Number 5.c. Item Number

5.d.

6.a. Page Number 6.b. Part Number 6.c. Item Number

6.d.

7.a. Page Number 7.b. Part Number 7.c. Item Number

7.d.

Form |

Page 8 of 8 |

File Attributes

| Fact Name | Description |

|---|---|

| Form Purpose | The I-864A is designed for a household member to contract with a sponsor to support an intending immigrant. |

| Form Title | Contract Between Sponsor and Household Member |

| Issuing Agency | U.S. Citizenship and Immigration Services (USCIS), Department of Homeland Security |

| OMB Control Number | 1615-0075 |

| Form Number | I-864A |

| Expiration Date | 12/31/2023 |

| Ink Color for Completion | The form must be completed in black ink. |

| Required Attachments | Photocopy or transcript of the Federal income tax return for the most recent tax year is required. |

| Potential Denial | Failure to fully complete the form or submit required documents may result in denial. |

| Key Sections | Includes information about the household member, relationship to the sponsor, employment and income, federal income tax information, and sponsor and household member declarations. |

Guidelines on How to Fill Out I 864A Affidavit Of Support

Filling out the I-864A Affidavit of Support form is an essential step for individuals in the process of sponsoring a family member for immigration to the United States. This form establishes a contract between a sponsor or household member and the U.S. government, promising financial support for the intending immigrant. The process requires attention to detail and accuracy to ensure all information is correctly provided, helping to prevent potential delays in the immigration process. Below are the steps needed to fill out the I-864A form properly.

- Start by typing or printing in black ink to ensure all information is legible.

- In Part 1, provide the requested Information About You (the Household Member), including your full name, mailing, and physical address. Also, include your date and place of birth, U.S. Social Security Number, and USCIS Online Account Number if available.

- For Part 2, detail Your (the Household Member's) Relationship to the Sponsor, selecting the appropriate option that describes your relationship and providing the necessary details.

- Under Part 3, describe Your (the Household Member's) Employment and Income. Include your current employment status, employer's name(s), and your current annual income.

- In Part 4, provide Your (the Household Member's) Federal Income Tax Information and Assets. Answer whether you have filed a federal income tax return for the past three years and attach photocopies or transcripts of your returns as required.

- Part 5 requires the Sponsor's Promise, Statement, Contact Information, Declaration, Certification, and Signature. If you are also the sponsor, complete this section with your contact information, your declaration and certification of the information provided, and your signature.

- For Part 6, as the household member, pledge your financial support if necessary. Provide your statement, contact information, declaration, and certification. Review the penalties section of the I-864A instructions before completing this part.

- If applicable, fill out Part 7 with the Interpreter's Contact Information, Certification, and Signature, should an interpreter have assisted in filling out the form.

- The household member must review all parts, ensuring all information is accurate, complete, and true, and then sign and date the form where indicated.

After completing and reviewing the form for accuracy, it should be submitted alongside all required documentation as instructed by USCIS. Proper submission of this form and adherence to all instructions are crucial for a successful sponsorship process. This step is fundamental in ensuring the intending immigrant has the necessary financial support upon arriving in the United States.

Discover More on I 864A Affidavit Of Support

What is Form I-864A?

Form I-864A, titled "Contract Between Sponsor and Household Member," is a document used in the United States immigration process. It allows a member of the sponsor's household to agree to support an intending immigrant financially. This form essentially forms a legal agreement between the sponsor and a household member, where the household member agrees to use their income and assets to support the immigrant, making themselves jointly liable along with the sponsor for the financial obligations.

Who needs to complete Form I-864A?

Form I-864A should be completed by a household member who wants to help support an immigrant, along with the main sponsor, by combining their income with the sponsor's income to meet the financial requirements set by immigration laws. This often involves spouse, adult children, parents, or siblings living in the same household as the sponsor.

How does Form I-864A differ from Form I-864?

While Form I-864, Affidavit of Support, is an agreement made by the sponsor to provide financial support to the immigrant, Form I-864A is an agreement between a sponsor and another household member who agrees to also support the immigrant. Essentially, Form I-864A allows additional financial resources from the sponsor's household to be considered in meeting the minimum income requirements, extending financial responsibility to other household members.

What are the obligations of a household member who signs Form I-864A?

By signing Form I-864A, a household member agrees to be jointly responsible with the sponsor for the financial support of the sponsored immigrant. This includes ensuring that the immigrant's income level remains at least 125% of the Federal Poverty Guidelines. The household member also becomes jointly liable for reimbursing any agencies that provide means-tested public benefits to the immigrant.

Can Form I-864A be withdrawn after submission?

No, once Form I-864A is submitted to U.S. Citizenship and Immigration Services (USCIS), it cannot be withdrawn. The financial obligations and liabilities remain effective until the sponsored immigrant becomes a U.S. citizen, has worked 40 qualifying quarters credited towards Social Security, leaves the United States permanently, or passes away.

What happens in the case of divorce between the sponsor and the household member who signed Form I-864A?

The divorce between a sponsor and a household member does not terminate the household member's financial obligations under Form I-864A. The responsibilities continue unaffected by the change in marital status unless one of the conditions for terminating obligations is met.

Are there income requirements for a household member filling out Form I-864A?

Yes, the household member must demonstrate that their income is at least 125% of the Federal Poverty Guidelines for their household size, including the sponsored immigrant(s). They must also show they have resided with the sponsor and will continue to do so.

What documents are required to accompany Form I-864A?

Required documents include the household member's proof of U.S. citizenship, legal permanent resident status, or U.S. national status; proof of domicile in the United States; proof of income and assets, such as tax returns, W-2s, or pay stubs; and proof of the relationship to the sponsor.

How long does the household member's financial responsibility last?

The financial responsibility of the household member lasts until the immigrant becomes a U.S. citizen, can be credited with 40 qualifying quarters of work (usually 10 years), permanently leaves the United States, or dies. It does not end with divorce or changes in the household member's financial situation.

Common mistakes

Failing to completely fill out all required sections of the Form I-864A can lead to delays or denial. Accuracy in providing all requested information is crucial since this form establishes the financial responsibility for supporting a household member who is seeking to become a U.S. permanent resident.

Not attaching the necessary documentation such as the most recent Federal income tax return, and if opted, the second and third most recent tax years' returns. These documents are essential to verify the household member's income and ability to support the intending immigrant.

Overlooking the signature area at the end of the form. An unsigned form is considered incomplete by U.S. Citizenship and Immigration Services (USCIS) and will not be processed until properly signed by both the sponsor and the household member.

Misunderstanding the relationship to the sponsor section can result in incorrectly filled forms. It's important to clearly identify the nature of the relationship to ensure the form meets the specific criteria for sponsorship.

Incorrectly reporting income or assets, whether by miscalculation or misunderstanding what is considered as income or an asset. This mistake can significantly impact the evaluation of the affidavit's support adequacy.

Using outdated forms or not adhering to the latest instructions can lead to processing delays. Always make sure to use the most current version of Form I-864A and review the latest instructions provided by USCIS.

Not specifying the total number of intending immigrants the sponsor is supporting with the affidavit. This detail is vital for assessing the sponsor's financial capability to support the additional household member(s).

Entering incorrect or outdated personal information, such as addresses or dates of birth, can lead to unnecessary complications. It’s especially important to ensure that all personal details are current and accurately reflect legal documents.

In summary, when completing the I-864A Affidavit of Support form, attention to detail is paramount. Each section must be thoroughly reviewed to ensure accuracy and completeness. Furthermore, it's essential to include all required documents and signatures. By avoiding common mistakes, sponsors and household members can contribute to a smoother process.

Documents used along the form

When completing the Form I-864A, Contract Between Sponsor and Household Member, applicants often need to gather and complete additional forms and documents to ensure a smooth application process. These accompanying documents are crucial for providing evidence and meeting the requirements set out by U.S. Citizenship and Immigration Services (USCIS). Here’s a list of other forms and documents that are frequently used alongside the Form I-864A:

- Form I-864, Affidavit of Support Under Section 213A of the INA: This form is an agreement between the sponsor and the U.S. government, ensuring that the immigrant will not become a public charge.

- Form I-485, Application to Register Permanent Residence or Adjust Status: This form is used by an applicant who is in the United States to apply for lawful permanent resident status.

- Form I-130, Petition for Alien Relative: A U.S. citizen or lawful permanent resident uses this form to establish their relationship to certain alien relatives who wish to immigrate to the United States.

- Passport-style photos: Typically, two recent photos are required for the immigrant beneficiary as part of the application process.

- Birth certificates: These are needed for proof of relationship between the sponsor and the beneficiary, as well as for the beneficiary’s identity.

- Marriage certificate: If the sponsorship is based on a marital relationship, this document must be provided to establish the validity of the marriage.

- Divorce decree(s): If either the sponsor or the beneficiary has been previously married, divorce documents are necessary to prove those marriages have been legally terminated.

- Financial statements and evidence: Documents such as bank statements, employment letters, and tax returns from the most recent tax year are required to show the sponsor’s financial stability.

- Proof of U.S. Citizenship or Permanent Residency: The sponsor must provide evidence such as a copy of a U.S. passport, birth certificate, naturalization certificate, or green card.

- W-2s and/or 1099 forms: These documents are used to verify the sponsor’s income as reported in their tax returns.

Each of these documents plays a vital role in building a robust affidavit of support package. It is important for sponsors and household members to carefully review and fulfill all requirements to avoid delays in the immigrant’s application process. Ensuring that all forms are accurately completed and all necessary documents are included will help streamline the review by USCIS.

Similar forms

The Form I-130, Petition for Alien Relative, is a document utilized by U.S. citizens or lawful permanent residents to establish a familial relationship with a foreign national they intend to sponsor for immigration to the United States. Much like the Form I-864A, the I-130 serves as a foundational element in the family-based immigration process, requiring the petitioner to provide detailed information about themselves and the beneficiary to the U.S. Citizenship and Immigration Services (USCIS). Both forms are critical in the journey toward securing a green card for the beneficiary, albeit serving different stages and purposes in the process.

Form I-485, Application to Register Permanent Residence or Adjust Status, is another document closely linked to the I-864A in the immigration continuum. While the I-864A is an agreement ensuring financial support for intending immigrants already within the U.S. or seeking admission, the I-485 is the next step for those beneficiaries eligible to apply for permanent residency within the United States. Applicants must often provide evidence of an accepted or pending I-864A to prove they won't become public charges, underlining the interconnectedness of these documents in achieving residency status.

Similar in purpose to the I-864A, the Form I-864, Affidavit of Support Under Section 213A of the INA, is utilized by sponsors to demonstrate they have sufficient income or assets to support immigrants coming to the U.S. Unlike the I-864A, which is an agreement between a sponsor and a household member, the I-864 involves a direct promise from the sponsor to the U.S. government. Both forms are vital to ensuring that immigrants have financial support and do not rely on government assistance, emphasizing the sponsor's commitment to the immigrant's well-being.

Form I-134, Affidavit of Support, bears similarities to the I-864A, as it is also a document used to show a sponsor’s financial support for someone coming to the U.S. However, the I-134 is typically employed for temporary visits, including for fiancé(e) visas or student visas, as opposed to the I-864A’s role in permanent residency applications. This distinction highlights the different scopes of financial responsibility undertaken by the sponsor, with the I-134 providing a less formal promise compared to the legally binding nature of the I-864A in the context of permanent immigration.

The DS-260, Immigrant Visa Electronic Application, while not a direct financial support form, is integrally related to the I-864A in the immigrant visa process. As part of obtaining a green card from outside the United States, applicants must accurately complete the DS-260 after a sponsor has filed an I-130 petition on their behalf. The process often includes submitting an I-864A to demonstrate financial stability and support. This sequential relationship between the forms underscores the comprehensive vetting process involved in immigrating to the United States, with financial solvency being a critical component.

Dos and Don'ts

When completing the Form I-864A Affidavit of Support, it is crucial to adhere to specific guidelines to ensure the process moves smoothly and to avoid any potential complications. Below are essential do's and don'ts:

- Do ensure all information provided is complete and accurate. Inconsistencies or errors can result in delays or denial.

- Do use black ink if filling out the form by hand. This ensures the form is legible and photocopies clearly.

- Do include all required documentation. This typically includes the most recent tax returns, employment evidence, and any necessary assets to meet income requirements.

- Do make and keep copies of the completed form and all accompanying documents for your records before submitting them to USCIs.

- Do review the form thoroughly before signing to certify that all the information is complete, true, and correct under penalty of perjury.

- Do consult with a legal advisor or attorney if there are any questions or complexities in your situation to ensure the form is filled out correctly.

- Don't leave any sections blank. If a section does not apply, write "N/A" (not applicable) to indicate that you have read and addressed every part of the form.

- Don't submit the form without the latest version. Always check the USCIS website for the most current form to avoid processing delays.

- Don't provide false information or attempt to mislead in any part of the affidavit. This can result in legal penalties, including fines or imprisonment.

- Don't forget to sign and date the form. An unsigned form will be rejected.

- Don't overlook the requirement to submit photocopies or transcripts of your Federal income tax returns for the most recent tax year, as this is a critical component of the affidavit.

- Don't hesitate to ask for help from a qualified professional if you're unsure about how to complete the form accurately. It's better to seek assistance than to submit an incorrect or incomplete form.

Misconceptions

When dealing with the Form I-864A, or the Affidavit of Support Contract Between Sponsor and Household Member, individuals often encounter misconceptions about its purpose, use, and implications. Clearing up these misunderstandings is crucial for both sponsors and household members to navigate the process accurately and effectively.

It's the same as Form I-864. A common misconception is that Form I-864A is the same as Form I-864. While they are related, Form I-864 is the Affidavit of Support Under Section 213A of the INA, used by sponsors to show they can support the immigrant financially. Form I-864A is a contract between a sponsor and a household member where the household member agrees to help support the immigrant, adding their income to the sponsor’s income to meet the financial requirements.

Any family member can sign Form I-864A. Not all family members can sign this form. Only family members who are residing in the same household as the sponsor and whose income can be considered for meeting the minimum income requirement can sign Form I-864A. This generally includes the sponsor’s spouse, children over 18, parents, or siblings, provided they are living together and their incomes are combined to support the immigrant.

Signing Form I-864A does not have legal implications. This is inaccurate. By signing Form I-864A, the household member agrees to join the primary sponsor in being financially responsible for the intending immigrant. Should the immigrant receive public assistance, the sponsor and the household member could both be held liable to reimburse the cost to the government. The commitment is legally enforceable and has significant financial implications.

The household member’s income is automatically included. Merely living with a sponsor does not automatically include a household member’s income for the affidavit of support. The household member must actively agree to make their income available by signing Form I-864A. Furthermore, their income must be proven to come from a lawful source and be sustainable from the same source, as evidenced through documentation such as tax returns, employment letters, etc.

Household members are obligated indefinitely. The obligation for a household member under Form I-864A usually ends when the immigrant becomes a U.S. citizen, can be credited with 40 quarters of work in the United States, permanently leaves the U.S., or passes away. It does not continue indefinitely and is bound by the same conditions that apply to the sponsor's support obligations.

Understanding these nuances helps sponsors and household members to make informed decisions and to fulfill their obligations accurately under the U.S. immigration law. Misinterpretations can lead to challenges and legal complications that may impact the immigrant's residency status and the financial responsibilities of those who sign the form.

Key takeaways

Filling out and properly using the Form I-864A, Affidavit of Support, is crucial for individuals involved in sponsoring a family member for immigration to the United States. Here are six key takeaways to remember:

- The Form I-864A is a contractual agreement between a sponsor and a household member, aimed at providing financial support to the intending immigrant. This ensures that the immigrant does not rely on public benefits, upholding the minimum income requirement set by the Immigration and Naturalization Act.

- To be eligible as a household member, one must either be the sponsor's spouse, have reached the age of 18 years, or qualify under another eligible relationship such as a parent, sibling, son, or daughter. The importance of accurately describing this relationship cannot be overstated, as it establishes the basis for the agreement.

- Accurate and thorough reporting of the household member's employment and income is mandatory. This includes detailing current employment status, employer names, and the individual's annual income. Such information is vital, demonstrating the household's ability to support the intending immigrant.

- Documentation of the household member's Federal income tax returns for the three most recent tax years is required. This includes not only the most recent year but optionally, the second and third most recent years. Providing these documents is essential to verify income claims and fulfill legal requirements.

- Declaration and certification by both the sponsor and the household member are key components of Form I-864A. Parties involved must certify that all information provided is complete, true, and correct, under penalty of perjury. The integrity of this information is critical for the affidavit's approval.

- Both the household member and the sponsor must understand their responsibility towards the intending immigrant, agreeing to be jointly and severally liable for any obligations that arise under the affidavit of support. This mutual commitment underscores the gravity and significance of the form.

Understanding these elements is not just about compliance with immigration procedures; it's about ensuring a supportive, legally sound framework for helping family members immigrate to the United States. As such, detailed attention to completing Form I-864A accurately reflects a commitment to ethical responsibility and familial support.

Popular PDF Forms

Financial Affidavit Florida Divorce - Crucial for ensuring financial transparency, this affidavit provides a basis for equitable decisions in family legal matters for lower-income parties.

Wa State Excise Tax - It includes sections for both buyer and seller information to ensure accurate tax collection.