Fill Your Financial Affidavit 12 902 C Form

Engaging with the complexities of family law requires a thorough understanding of one's financial situation, especially in cases where substantial assets or income levels are at play. The Financial Affidavit 12 902 C form emerges as a critical document within this realm, designed for those navigating through family law cases in Florida and earning an annual gross income of $50,000 or more. This long form affidavit demands meticulous attention to detail, needing individuals to report a vast array of financial details, from income to expenses, in a structured and comprehensive manner. The necessity for this form arises under specific circumstances, excluding those pursuing a simplified dissolution of marriage without children or financial disputes, or when a written settlement has already addressed all financial matters. Including a clear directive to complete the affidavit in black ink, sign before a notary or deputy clerk, and ensure proper filing and service in accordance with Florida law, this document underscores the critical intersection of financial transparency and legal process. Further detailed instructions offer guidance on converting various payment schedules into monthly figures to ensure accuracy in reporting, while emphasizing the importance of confidentiality for victims of violence seeking to shield their address. Such meticulous documentation serves not just as a legal requirement but as a foundational pillar in the quest for fair resolutions within Florida's family law courts.

Document Sample

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULE OF PROCEDURE FORM 12.902(c), FAMILY LAW FINANCIAL AFFIDAVIT (LONG FORM)(01/15)

When should this form be used?

This form should be used when you are involved in a family law case which requires a financial affidavit and your individual gross income is $50,000 OR MORE per year unless:

(1)You are filing a simplified dissolution of marriage under rule 12.105 and both parties have waived the filing of financial affidavits;

(2)you have no minor children, no support issues, and have filed a written settlement agreement disposing of all financial issues; or

(3)the court lacks jurisdiction to determine any financial issues.

This form should be typed or printed in black ink. After completing this form, you should sign the form before a notary public or deputy clerk. You should then file the original with the clerk of the circuit court in the county where the petition was filed and keep a copy for your records.

What should I do next?

A copy of this form must be served on the other party in your case within 45 days of being served with the petition, if it is not served on him or her with your initial papers. Service must be in accordance with Florida Rule of Judicial Administration 2.516.

Where can I look for more information?

Before proceeding, you should read “General Information for

Special notes...

If you want to keep your address confidential because you are the victim of sexual battery, aggravated child abuse, aggravated stalking, harassment, aggravated battery, or domestic violence do not enter the address, telephone, and fax information at the bottom of this form. Instead, file Request for Confidential Filing of Address, Florida Supreme Court Approved Family Law Form 12.980(h).

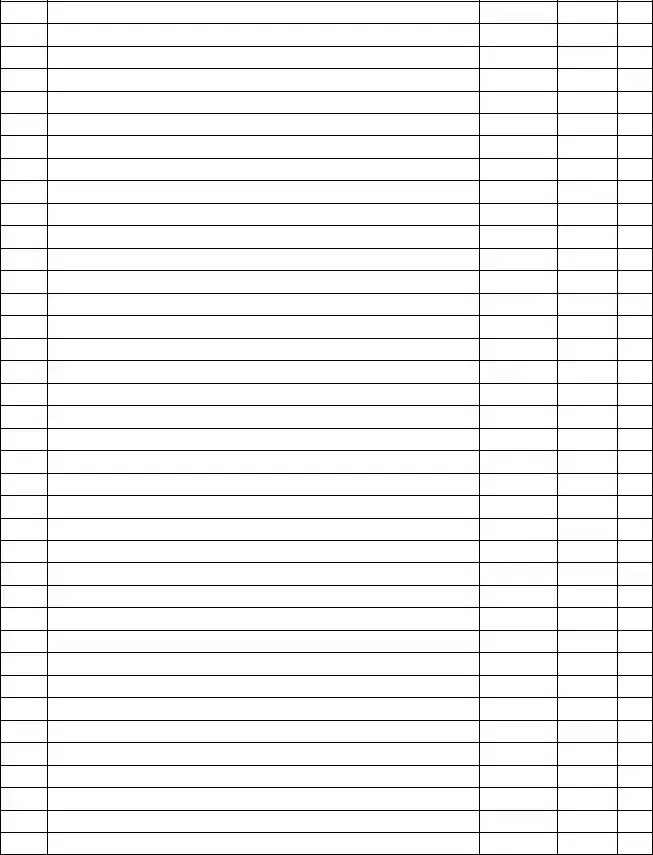

The affidavit must be completed using monthly income and expense amounts. If you are paid or your bills are due on a schedule which is not monthly, you must convert those amounts. Hints are provided below for making these conversions.

Instructions for Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

Hourly - If you are paid by the hour, you may convert your income to monthly as follows:

Hourly amount |

x |

Hours worked per week |

= |

Weekly amount |

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

Daily - If you are paid by the day, you may convert your income to monthly as follows: |

||||

Daily amount |

x |

Days worked per week |

= |

Weekly amount |

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

Weekly - If you are paid by the week, you may convert your income to monthly as follows:

Weekly amount |

x |

52 Weeks per year |

= |

Yearly amount |

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

follows: |

|

|

|

|

x |

26 |

= |

Yearly amount |

|

Yearly amount |

÷ |

12 Months per year |

= |

Monthly Amount |

2 |

= |

Monthly Amount |

Expenses may be converted in the same manner.

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these forms, that person must give you a copy of a Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also must put his or her name, address, and telephone number on the bottom of the last page of every form he or she helps you complete.

Instructions for Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

IN THE CIRCUIT COURT OF THE |

|

|

JUDICIAL CIRCUIT, |

|

IN AND FOR |

|

COUNTY, FLORIDA |

||

Case No.:

Division:

,

Petitioner,

and

,

Respondent.

FAMILY LAW FINANCIAL AFFIDAVIT (LONG FORM)

($50,000 or more Individual Gross Annual Income)

I, {full legal name} |

|

, being sworn, certify |

that the following information is true: |

|

|

SECTION I. INCOME

SECTION I. INCOME

1.My age is: ___________________

2.My occupation is: ________________________________________________________________

3.I am currently [Check all that apply]

a.____ Unemployed

Describe your efforts to find employment, how soon you expect to be employed, and the pay you expect to receive: __________________________________________________________

____________________________________________________________________________

b.____ Employed by: ____________________________________________________________

Address: ____________________________________________________________________

City, State, Zip code: ________________________________ Telephone Number: _________

Pay rate: $ ______ ( ) every week ( ) every other week ( ) twice a month

( ) monthly ( ) other: ________________________________________________________

If you are expecting to become unemployed or change jobs soon, describe the change you expect and why and how it will affect your income: _________________________________

___________________________________________________________________________

___________________________________________________________________________.

____ Check here if you currently have more than one job. List the information above for the

second job(s) on a separate sheet and attach it to this affidavit.

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

c._____ Retired. Date of retirement: _______________________________________________

Employer from whom retired: ___________________________________________________

Address: _____________________________________________________________________

City, State, Zip code: _______________________________ Telephone Number: __________

L!ST YE!R’S GROSS INCOME: |

Your Income |

Other Party’s Income (if known) |

YEAR_____ |

$ _______ |

$ _______ |

PRESENT MONTHLY GROSS INCOME:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT paid monthly. Attach more paper, if needed. Items included under “other” should be listed separately with separate dollar amounts.

1.$______ Monthly gross salary or wages

2._______ Monthly bonuses, commissions, allowances, overtime, tips, and similar payments

3._______ Monthly business income from sources such as

4._______ Monthly disability benefits/SSI

5._______ Monthly Workers’ Compensation

6._______ Monthly Unemployment Compensation

7._______ Monthly pension, retirement, or annuity payments

8._______ Monthly Social Security benefits

9._______ Monthly alimony actually received (Add 9a and 9b)

9a. From this case: $________

9b. From other case(s): ________

10._______ Monthly interest and dividends

11._______ Monthly rental income (gross receipts minus ordinary and necessary expenses required to produce income) (Attach sheet itemizing such income and expense items.)

12._______ Monthly income from royalties, trusts, or estates

13._______ Monthly reimbursed expenses and

14._______ Monthly gains derived from dealing in property (not including nonrecurring gains)

Any other income of a recurring nature (identify source)

15._______________________________________________________________________________

16._______________________________________________________________________________

17.$_________ TOTAL PRESENT MONTHLY GROSS INCOME (Add lines 1 through 16).

PRESENT MONTHLY DEDUCTIONS:

All amounts must be MONTHLY. See the instructions with this form to figure out money amounts for anything that is NOT paid monthly.

18.$_______ Monthly federal, state, and local income tax (corrected for filing status and allowable dependents and income tax liabilities)

a.Filing Status

b.Number of dependents claimed

19. |

_______ |

Monthly FICA or |

20. _______ |

Monthly Medicare payments |

|

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

21._______ Monthly mandatory union dues

22._______ Monthly mandatory retirement payments

23._______ Monthly health insurance payments (including dental insurance), excluding portion paid for any minor children of this relationship

24._______ Monthly

25._______ Monthly

25a. from this case: $ _________

25b. from other case(s): _________

26.$______ TOTAL DEDUCTIONS ALLOWABLE UNDER SECTION 61.30, FLORIDA STATUTES (Add lines 18 through 25).

27.$______ PRESENT NET MONTHLY INCOME

(Subtract line 26 from line 17).

SECTION II. AVERAGE MONTHLY EXPENSES

SECTION II. AVERAGE MONTHLY EXPENSES

Proposed/Estimated Expenses. If this is a dissolution of marriage case and your expenses as listed below do not reflect what you actually pay currently, you should write “estimate” next to each amount that is estimated.

HOUSEHOLD:

1.$______ Monthly mortgage or rent payments

2._______ Monthly property taxes (if not included in mortgage)

3._______ Monthly insurance on residence (if not included in mortgage)

4._______ Monthly condominium maintenance fees and homeowner’s association fees

5._______ Monthly electricity

6._______ Monthly water, garbage, and sewer

7._______ Monthly telephone

8._______ Monthly fuel oil or natural gas

9._______ Monthly repairs and maintenance

10._______ Monthly lawn care

11._______ Monthly pool maintenance

12._______ Monthly pest control

13._______ Monthly misc. household

14._______ Monthly food and home supplies

15._______ Monthly meals outside home

16._______ Monthly cable t.v.

17._______ Monthly alarm service contract

18._______ Monthly service contracts on appliances

19._______ Monthly maid service

Other:

20.__________________________________________________________________________________

21.__________________________________________________________________________________

22.__________________________________________________________________________________

23.__________________________________________________________________________________

24.__________________________________________________________________________________

25.$_______ SUBTOTAL (add lines 1 through 24).

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

AUTOMOBILE:

26.$______ Monthly gasoline and oil

27._______ Monthly repairs

28._______ Monthly auto tags and emission testing

29._______ Monthly insurance

30._______ Monthly payments (lease or financing)

31._______ Monthly rental/replacements

32._______ Monthly alternative transportation (bus, rail, car pool, etc.)

33._______ Monthly tolls and parking

34._______ Other: _________________________________________________

35.$_______ SUBTOTAL (add lines 26 through 34)

MONTHLY EXPENSES FOR CHILDREN COMMON TO BOTH PARTIES:

36.$______ Monthly nursery, babysitting, or day care

37._______ Monthly school tuition

38._______ Monthly school supplies, books, and fees

39._______ Monthly after school activities

40._______ Monthly lunch money

41._______ Monthly private lessons or tutoring

42._______ Monthly allowances

43._______ Monthly clothing and uniforms

44._______ Monthly entertainment (movies, parties, etc.)

45._______ Monthly health insurance

46._______ Monthly medical, dental, prescriptions (nonreimbursed only)

47._______ Monthly psychiatric/psychological/counselor

48._______ Monthly orthodontic

49._______ Monthly vitamins

50._______ Monthly beauty parlor/barber shop

51._______ Monthly nonprescription medication

52._______ Monthly cosmetics, toiletries, and sundries

53._______ Monthly gifts from child(ren) to others (other children, relatives, teachers, etc.)

54._______ Monthly camp or summer activities

55._______ Monthly clubs (Boy/Girl Scouts, etc.)

56._______ Monthly

57._______ Monthly miscellaneous

58.$_______ SUBTOTAL (add lines 36 through 57)

MONTHLY EXPENSES FOR CHILD(REN) FROM ANOTHER RELATIONSHIP (other than

59.$________________________________________________________________________________

60.__________________________________________________________________________________

61.__________________________________________________________________________________

62.__________________________________________________________________________________

63.$_______ SUBTOTAL (add lines 59 through 62)

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

MONTHLY INSURANCE:

64.$______ Health insurance (if not listed on lines 23 or 45)

65._______ Life insurance

66._______ Dental insurance.

Other:

67.________________________________________________________________________________

68.________________________________________________________________________________

69.. $_______ SUBTOTAL (add lines 66 through 68, exclude lines 64 and 65)

OTHER MONTHLY EXPENSES NOT LISTED ABOVE:

70.$______ Monthly dry cleaning and laundry

71._______ Monthly clothing

72._______ Monthly medical, dental, and prescription (unreimbursed only)

73._______ Monthly psychiatric, psychological, or counselor (unreimbursed only)

74._______ Monthly

75._______ Monthly grooming

76._______ Monthly gifts

77._______ Monthly pet expenses

78._______ Monthly club dues and membership

79._______ Monthly sports and hobbies

80._______ Monthly entertainment

81._______ Monthly periodicals/books/tapes/CDs

82._______ Monthly vacations

83._______ Monthly religious organizations

84._______ Monthly bank charges/credit card fees

85._______ Monthly education expenses

86.______ Other: (include any usual and customary expenses not otherwise mentioned in the items

listed above)______________________________________________________________

87.__________________________________________________________________________________

88.__________________________________________________________________________________

89.__________________________________________________________________________________

90. $_______ SUBTOTAL (add lines 70 through 89)

MONTHLY PAYMENTS TO CREDITORS: (only when payments are currently made by you on outstanding balances). List only last 4 digits of account numbers.

MONTHLY PAYMENT AND NAME OF CREDITOR(s):

91.$_________________________________________________________________________________

92.__________________________________________________________________________________

93.__________________________________________________________________________________

94.__________________________________________________________________________________

95.__________________________________________________________________________________

96.__________________________________________________________________________________

97.__________________________________________________________________________________

98.__________________________________________________________________________________

99.__________________________________________________________________________________

100.______________________________________________________________________________

101.______________________________________________________________________________

102.______________________________________________________________________________

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

103.______________________________________________________________________________

104. $_______ SUBTOTAL (add lines 91 through 103)

105. $_______TOTAL MONTHLY EXPENSES:

(add lines 25, 35, 58, 63, 69, 90, and 104 of Section II, Expenses)

SUMMARY

106. $_______ TOTAL PRESENT MONTHLY NET INCOME (from line 27 of SECTION I. INCOME)

107. $_______ TOTAL MONTHLY EXPENSES (from line 105 above)

108. $_______ SURPLUS (If line 106 is more than line 107, subtract line 107 from line 106. This is the

amount of your surplus. Enter that amount here.)

109. ($______)(DEFICIT) (If line 107 is more than line 106, subtract line 106 from line 107. This is

the amount of your deficit. Enter that amount here.)

SECTION III. ASSETS AND LIABILITIES

SECTION III. ASSETS AND LIABILITIES

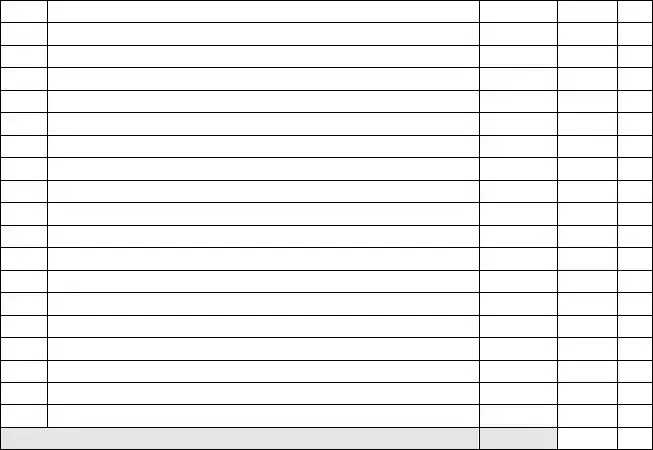

A.ASSETS (This is where you list what you OWN.)

INSTRUCTIONS:

STEP 1: In column A, list a description of each separate item owned by you (and/or your spouse, if this is a petition for dissolution of marriage). Blank spaces are provided if you need to list more than one of an item.

STEP 2: If this is a petition for dissolution of marriage, check the line in Column A next to any item that you are requesting the judge award to you.

STEP 3: In column B, write what you believe to be the current fair market value of all items listed.

STEP 4: Use column C only if this is a petition for dissolution of marriage and you believe an item is “nonmarital,” meaning it belongs to only one of you and should not be divided. You should indicate to whom you believe the item belongs. (Typically, you will only use Column C if property was owned by one spouse before the marriage. See the “General Information for

|

|

A |

|

B |

|

C |

|

|

|

ASSETS: DESCRIPTION OF ITEM(S) |

Nonmarital |

||||

|

|

|

Current |

|

|||

|

LIST ONLY LAST FOUR DIGITS OF ACCOUNT NUMBERS. |

|

Fair |

|

(Check correct |

||

|

|

Market |

|

column) |

|||

|

Check the line next to any asset(s) which you are requesting the judge award |

|

Value |

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

to you. |

|

|

|

husband |

wife |

|

|

|

Cash (on hand) |

$ |

|

|

|

|

|

|

Cash (in banks or credit unions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stocks/Bonds |

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

Notes (money owed to you in writing)

Money owed to you (not evidenced by a note)

Real estate: (Home)

(Other)

Business interests

Automobiles

Boats

Other vehicles

Retirement plans (Profit Sharing, Pension, IRA, 401(k)s, etc.)

Furniture & furnishings in home

Furniture & furnishings elsewhere

Collectibles

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

Jewelry

Life insurance (cash surrender value)

Sporting and entertainment (T.V., stereo, etc.) equipment

Other assets:

Total Assets (add column B)

$

B.LIABILITIES/DEBTS (This is where you list what you OWE.)

INSTRUCTIONS:

STEP 1: In column A, list a description of each separate debt owed by you (and/or your spouse, if this is a petition for dissolution of marriage). Blank spaces are provided if you need to list more than one of an item.

STEP 2: If this is a petition for dissolution of marriage, check the line in Column A next to any debt(s) for which you believe you should be responsible.

STEP 3: In column B, write what you believe to be the current amount owed for all items listed.

STEP 4: Use column C only if this is a petition for dissolution of marriage and you believe an item is “nonmarital,” meaning the debt belongs to only one of you and should not be divided; You should indicate to whom you believe the debt belongs. (Typically, you will only use Column C if the debt was owed by one spouse before the marriage. See the “General Information for Self- Represented Litigants” found at the beginning of these forms and section 61.075(1), Florida Statutes, for definitions of “marital” and “nonmarital” assets and liabilities.)

Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (Long Form) (01/15)

File Attributes

| Fact | Detail |

|---|---|

| Usage Criteria | The form should be used in family law cases requiring a financial affidavit when the individual's gross income is $50,000 or more per year. |

| Exceptions for Use | Exceptions include filing for a simplified dissolution of marriage, no minor children or support issues, or when the court lacks jurisdiction over financial matters. |

| Format Specifications | The form must be typed or printed in black ink and signed before a notary public or deputy clerk. |

| Filing Requirement | After completion, the original form must be filed with the clerk of the circuit court where the petition was filed. |

| Service on Other Party | A copy must be served to the other party within 45 days of being served with the petition, if not served with the initial papers. |

| Service Method | Service must comply with Florida Rule of Judicial Administration 2.516. |

| Income and Expense Conversion | Monthly income and expense amounts are required; instructions for converting non-monthly income and expenses are provided. |

| Privacy Consideration | If confidentiality due to being a victim of certain crimes is needed, do not enter address information and instead file a Request for Confidential Filing of Address. |

| Governing Law | The form is governed by and must be in compliance with Florida Family Law Rule of Procedure 12.285. |

Guidelines on How to Fill Out Financial Affidavit 12 902 C

Filling out a Financial Affidavit Form 12.902(c) can seem daunting due to its importance in a family law case. This document is required when an individual's gross income is $50,000 or more per year. It provides a thorough record of your financial status, including income, expenses, and deductions. This form plays a crucial role in proceedings like divorce, child support, and alimony cases. Ensuring that all the information is accurate and complete is vital. Follow these steps to correctly fill out the form.

- Start by typing or printing in black ink your full legal name as it appears on the form's header, alongside the case number, division, and names of both parties involved.

- Section I. Income:

- Enter your age and occupation.

- Check the appropriate box to indicate your current employment status, and if applicable, provide details as requested. If you are expecting changes in your employment or income, describe them.

- If you are retired, enter the date of retirement, employer's name, and contact information.

- List last year's gross income and, if known, the other party's income.

- Detail your present monthly gross income across all categories listed. Use the conversion instructions provided in the form if your income or bills are not in a monthly format. Attach additional sheets if needed for clarity.

- Calculate and enter your total present monthly gross income.

- Section I. Deductions:

- Enter your monthly deductions, including taxes, FICA, Medicare, union dues, retirement payments, health insurance (excluding amounts paid for any minor children of this relationship), child support, and alimony paid for cases other than yours. Each category should reflect a monthly amount, after conversions if necessary.

- Sum up the deductible amounts to find your total allowable deductions.

- Subtract the total deductions from your total gross income to calculate your present net monthly income.

- Section II. Average Monthly Expenses: List your average or estimated monthly household expenses in detail. If you're not sure about an exact amount, mark it as "estimated." Cover all areas from mortgage or rent to miscellaneous household expenses. Remember to include any other specific expenses that don't fit into the predefined categories in the spaces provided at the end of the section.

- Review your form carefully, ensuring all information is accurate and complete. Remember, any inaccuracies could impact your case significantly.

- Sign the form before a notary public or deputy clerk. This verifies that the information you’ve provided is true to the best of your knowledge.

- File the original form with the clerk of the circuit court in the county where your case was filed, and keep a copy for your own records. A copy must also be served to the other party involved in your case within 45 days of being served with the petition if not served with your initial papers.

Completing the Financial Affidavit Form 12.902(c) with accuracy is a critical step in your family law case. It requires careful attention to detail and honesty throughout the process. If you encounter difficulties, consider seeking assistance from a legal professional or a certified nonlawyer, as permitted, ensuring they provide you with the necessary Disclosure from Nonlawyer form.

Discover More on Financial Affidavit 12 902 C

What is the purpose of the Family Law Financial Affidavit (Long Form) 12.902(c)?

This form is required in family law cases where an individual's gross income is $50,000 or more per year. It provides a detailed account of one's financial status, including income, expenses, assets, and liabilities. This affidavit is essential for determining financial aspects such as alimony, child support, and division of marital assets.

When should I not use this form?

You should not use this form if you are filing for a simplified dissolution of marriage and both parties have waived the filing of financial affidavits; if there are no minor children, no support issues, and a written settlement agreement disposing of all financial issues has been filed; or if the court lacks jurisdiction to determine any financial issues.

How should the Family Law Financial Affidavit (Long Form) be filled out and filed?

The form should be typed or printed in black ink. After completing it, sign the form in front of a notary public or deputy clerk. Then, the original must be filed with the clerk of the circuit court in the county where the petition was filed, and you should keep a copy for your records.

What is the deadline for serving the Family Law Financial Affidavit on the other party?

This affidavit must be served on the other party within 45 days of being served with the petition for your family law case, unless it was served with your initial papers. Service must comply with Florida Rule of Judicial Administration 2.516.

What should I do if I need to keep my address confidential?

If you are the victim of specific crimes such as sexual battery or domestic violence and wish to keep your address confidential, do not enter your address, telephone, or fax information on the form. Instead, file a Request for Confidential Filing of Address, using Florida Supreme Court Approved Family Law Form 12.980(h).

How do I calculate monthly income and expenses if I'm not paid monthly?

The form provides instructions for converting income and expenses to monthly amounts based on your pay schedule, whether it’s hourly, daily, weekly, bi-weekly, or semi-monthly. For expenses, follow the same conversion method.

Can I receive assistance filling out this form?

Yes, but if a nonlawyer helps you, they must provide you with a copy of a Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a), before they assist you. They must also include their name, address, and telephone number on the bottom of the last page of every form they help you complete.

What happens if my financial situation changes after filing the affidavit?

If your financial situation changes significantly after you file the affidavit, you may need to update your information with the court. This could involve filing an amended financial affidavit to reflect your new financial reality.

Is there a penalty for providing false information on this form?

Yes, providing false information on a financial affidavit can lead to serious consequences, including but not limited to sanctions from the court. It's crucial to provide accurate information to the best of your ability.

Where can I find more information?

For further details, you should read the "General Information for Self-Represented Litigants" found at the beginning of these forms. Additionally, you might consider consulting with an attorney or reviewing the Florida Family Law Rules of Procedure 12.285 for more in-depth information.

Common mistakes

Filling out the Family Law Financial Affidavit (Long Form) 12.902(c) is a crucial step in many family law cases, but mistakes can significantly impact the outcome. Below are common errors individuals often make when completing this form:

- Not thoroughly reading the instructions which lead to inaccuracies in the conversion of non-monthly income and expenses to their monthly equivalents.

- Failing to list all income sources, such as bonuses, commissions, or income from rental properties, which results in an incomplete financial picture.

- Overlooking or inaccurately reporting expenses, especially those that fluctuate throughout the year, causing either overstatement or understatement of financial needs.

- Omitting assets or debts, intentionally or unintentionally, which can lead to questions about credibility or even accusations of hiding assets.

- Incorrectly calculating deductions such as taxes, insurance premiums, or retirement contributions, affecting the net income portrayal.

- Not updating the affidavit to reflect significant changes in financial status, leading to decisions based on outdated information.

- Failing to attach necessary documentation for items such as additional sources of income or itemized expenses, which can delay proceedings or affect outcomes.

- Signing the document without verifying all the information, which can have legal consequences if inaccuracies are discovered later.

- Not consulting with a legal professional when unsure about how to complete the form or understand its implications, potentially risking the integrity of the financial declaration.

To avoid these mistakes, it is imperative to approach the completion of the Family Law Financial Affidavit with thoroughness, accuracy, and honesty. Seeking the advice of a legal professional can also provide guidance and clarity through this process.

Documents used along the form

When navigating through a family law case in Florida, particularly one involving complex financial issues, a plethora of documents other than the Family Law Financial Affidavit 12.902(c) may be necessary. Each of these documents plays a crucial role in providing a comprehensive view of an individual’s financial standing, ensuring the court has a clear understanding of the situation. From tax returns to proof of income, the array of documents required underscores the court's commitment to equitable decision-making. Understanding these documents is essential for anyone involved in such legal proceedings.

- Child Support Guidelines Worksheet (Form 12.902(e)): Utilized to calculate the amount of child support, based on the parents' income and the child's needs.

- Marital Settlement Agreement for Dissolution of Marriage with Dependent or Minor Child(ren) (Form 12.902(f)(1)): This document outlines the terms agreed upon by both parties regarding child support, custody, and division of marital assets and liabilities.

- Uniform Child Custody Jurisdiction and Enforcement Act (UCCJEA) Affidavit (Form 12.902(d)): Declares the child(ren)'s residence history, aiding the court in determining jurisdiction over custody matters.

- Notice of Social Security Number (Form 12.902(j)): Provides the court with both parties' social security numbers, a requirement in family law cases.

- Nonlawyer Disclosure Form (Form 12.900(a)): If a nonlawyer assists in filling out family law forms, this disclosure must be filed, detailing the nonlawyer's involvement.

- Request for Confidential Filing of Address (Form 12.980(h)): For individuals who wish to keep their address private due to safety concerns, such as cases of domestic violence.

- Income Deduction Order: If child support or alimony is awarded, this order directs an employer to deduct these payments directly from the payer’s wages.

- Proof of Income: Recent pay stubs, employment contracts, or other documents evidencing current income, essential for verifying financial information provided.

- Recent Tax Returns: Federal and state tax returns, including W-2s and 1099s, offer a detailed picture of an individual's financial history.

- Bank Statements: Recent statements from all checking, savings, investment, and retirement accounts, showcasing the current financial status.

Collecting and filing these documents, in addition to the Financial Affidavit 12.902(c), may seem daunting. However, they are vital for ensuring fairness and accuracy in family law proceedings. The requirement for such extensive documentation highlights the legal system's dedication to thorough review and equitable outcomes in family law cases. As laws and requirements can evolve, it’s always a good idea to seek guidance from legal professionals when navigating these processes.

Similar forms

The Financial Affidavit 12 902 C form shares similarities with the Personal Financial Statement. Both documents require detailed disclosures of income, expenses, and liabilities. They serve to provide a comprehensive picture of an individual's financial status, often required by financial institutions for loan assessments or in legal settings to adjudicate financial responsibilities. While the Financial Affidavit is used specifically in family law cases, the Personal Financial Statement can be required for a variety of reasons including loan applications, financial planning, and sometimes in legal proceedings beyond family law.

Another document akin to the Financial Affidavit 12 902 C form is the Child Support Guidelines Worksheet. This worksheet, used in family law, calculates the amount of child support a parent is obligated to pay based on their income, the child's needs, and other relevant financial information. Both forms require detailed financial information to ensure the equitable distribution of financial support responsibilities and to cater to the child's best interests, maintaining a focus on the individual’s financial capacity and obligations towards dependant care.

The Schedule C (Form 1040), Profit or Loss from Business, is also related to the Financial Affidavit 12 902 C. Both require detailed reporting of income and expenses, though the Schedule C focuses specifically on income and deductions associated with self-employment or sole proprietorship businesses. They both serve the purpose of providing a clear financial picture, but while the Schedule C influences tax liabilities and responsibilities, the Financial Affidavit supports legal determinations in family law matters.

The Statement of Net Worth, often used in divorce proceedings, is akin to the Financial Affidavit 12 902 C form as well. It necessitates a thorough disclosure of assets, liabilities, income, and expenses, helping to determine equitable division of assets and financial responsibilities post-divorce. Both documents play crucial roles in the fair resolution of financial disputes within family law, ensuring that all parties have a transparent understanding of each other's financial situation.

Loan Application Forms also share similarities with the Financial Affidavit 12 902 C form, as both require the disclosure of detailed personal financial information to assess monetary responsibility and capability. While Loan Application Forms help lenders decide on a borrower’s qualification for new credit based on their financial health, the Financial Affidavit is designed to facilitate judicial evaluations of financial matters in family law cases, including alimony, child support, and division of assets.

The Bankruptcy Schedules, required when filing for bankruptcy, closely relate to the information in the Financial Affidavit 12 902 C. These schedules detail the debtor's assets, liabilities, income, expenses, and financial transactions, similar to the affidavit's requirement for detailed personal financial disclosure. Both are instrumental in legal processes - the bankruptcy schedules in determining eligibility and the framework for bankruptcy proceedings, and the affidavit in family law cases to adjudicate financial responsibilities and entitlements.

Lastly, the Real Property Asset Declaration shares similarities with the Financial Affidavit 12 902 C form in terms of declaring assets. Specifically, it requires details on real estate holdings as part of an individual’s asset portfolio. While the Real Property Asset Declaration might focus on real estate assets for tax assessment or legal division of property, the Financial Affidavit provides a broader overview of an individual’s financial status, including real property, in family law contexts to aid in equitable financial resolutions.

Dos and Don'ts

When filling out the Financial Affidavit 12 902 C form, it's important to be thorough and attentive to detail. Here are several dos and don'ts to keep in mind:

- Do ensure the information is accurate and truthful. The affidavit is a sworn statement, and falsifying information can have legal consequences.

- Don't leave any sections blank if they apply to you. If a particular question does not apply, it's advisable to write "N/A" (not applicable) instead of leaving it blank.

- Do convert your income and expenses to monthly amounts, as required by the form. If you receive or pay amounts on a schedule other than monthly, follow the instructions provided for making conversions.

- Don't guess or estimate amounts without making an effort to determine the actual figures. Use actual documents or statements to fill in financial numbers wherever possible.

- Do keep a copy of the completed form and all documents used in preparing it for your records. These may be needed for future reference or to provide proof of the information provided.

- Don't include sensitive personal information if confidentiality is a concern, especially if you are a victim of abuse and there's an existing request for confidential filing of address.

- Do seek assistance if needed. If you are having trouble understanding how to complete the form, it may be helpful to consult with an attorney or a court clerk, while being aware of the limitations on legal advice they can provide.

Following these guidelines can help ensure that the Financial Affidavit is completed correctly, which is crucial for your case. It is an essential step in providing the court with an accurate picture of your financial situation, which can affect the outcome of family law proceedings.

Misconceptions

There are several common misconceptions about the Florida Family Law Financial Affidavit (Long Form) - 12.902(c) that can lead to confusion. Let’s clear some of these up:

- Only high-income individuals need to fill it out. While it's true this form is required if your gross annual income is $50,000 or more, it’s not exclusively for the "wealthy." This threshold is relatively moderate and encompasses a wide range of middle-class individuals.

- It's optional in family law cases. This form is mandatory in relevant family law cases that meet the income criteria. Opting out without meeting specific conditions could lead to legal complications.

- All financial information is disclosed publicly. If you have concerns about revealing sensitive information, such as being a victim of violence or harassment, there are provisions to keep your address confidential.

- Monthly income and expenses need to be reported as is. Actually, if your income or expenses don’t come in monthly, you're required to convert these figures to monthly amounts. The form provides guidance on how to do this calculation.

- Filling it out is straightforward and quick. Given the comprehensive details required, including various income sources and monthly expenses, completing this affidavit can be time-consuming and requires careful attention to accuracy.

- You don’t need to update it once it’s filed. Circumstances change, and if significant changes to your financial situation occur, you may need to update the information in your affidavit.

- The instructions are complex and hard to understand. While the document is thorough, it comes with detailed instructions designed to help you through each step, even converting different types of income into monthly amounts.

- If you have a lawyer, you don't need to worry about it. Even if you have legal representation, it's crucial you understand and provide accurate information for this form. Your lawyer can help clarify questions but relying solely on them without your input can lead to inaccuracies.

- Any nonlawyer can help you fill it out. If seeking assistance from a nonlawyer, they must provide you with a specific form (Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a)) before they help you. They’re also required to include their name, address, and phone number on the last page of the forms they assist with.

Understanding these key points ensures you approach the Family Law Financial Affidavit (Long Form) with the seriousness and precision it requires, helping you navigate your legal process with confidence.

Key takeaways

When navigating family law matters that necessitate a financial affidavit in Florida and individual gross income exceeds $50,000 annually, the Financial Affidavit 12.902(c) plays a crucial role. Here are key takeaways for accurately completing and utilizing this document:

- Filling out the Financial Affidavit 12.902(c) is essential in family law cases where financial disclosure is required, except under specific conditions where waiver or settlement agreements are in place, or if the court does not have jurisdiction over financial issues.

- This document must be filled out with monthly financial figures. For those earning or paying expenses at other intervals, conversions to monthly amounts are provided, ensuring accurate representation of one's financial stance.

- Accuracy is paramount when completing the affidavit. It demands a clear outline of gross income, inclusive of salary, bonuses, self-employment income, and any other income sources, transitioning these to monthly figures if necessary.

- Understanding and including allowable monthly deductions such as taxes, retirement contributions, and insurance payments provides an accurate picture of net income, critical for determining financial obligations in legal proceedings.

- It is a requirement to disclose monthly expenses in detail across various categories, including household, transportation, and personal expenses. Estimating expenses might be necessary if exact figures are not readily available, especially in dissolution of marriage cases.

- For those with more than one job or varied sources of income, the affidavit allows for additional sheets to be attached, ensuring that no source of income is overlooked.

- Special instructions are included for victims of certain crimes who wish to keep their address confidential, highlighting the form's role in protecting vulnerable individuals.

- Transparency and completeness in filling out the form can significantly impact legal proceedings, potentially influencing decisions related to alimony, child support, and asset division.

- Before submission, the document must be signed in front of a notary public or deputy clerk, verifying the truthfulness and accuracy of the information provided.

- Timeliness in serving the completed affidavit to the opposing party is dictated by Florida law, typically within 45 days of being served with the petition for a family law case, reinforcing the legal process and ensuring fairness.

- Seeking guidance from a legal professional or utilizing resources offered for self-represented litigants can aid in navigating the complexities of the affidavit, ensuring it is completed correctly and effectively.

Properly completed and used, the Financial Affidavit 12.902(c) form is a powerful tool in family law proceedings, ensuring an equitable and just resolution based on transparent financial disclosure.

Popular PDF Forms

Affidavit for Child Custody - A legally sanctioned form for parents looking to officially relinquish their parental rights.

Contractor's Affidavit - A written sworn statement by a contractor attesting to the receipt of payment for work on a property project.

Ccsd Residential Affidavit - This affidavit's notarization requirement underscores its legal significance, ensuring all parties recognize the serious commitment they are undertaking in declaring a student's residence.