Fill Your Arizona Repossession Affidavit Form

When it comes to reclaiming possession of a vehicle due to a default on payments, the Arizona Repossession Affidavit form serves as a crucial document for lienholders. This detailed affidavit, under the Vehicle Division 48-0902 R08/22 available through the Arizona Department of Transportation's website, must be competently filled out by the legal owner and lienholder of the vehicle. It not only requires a comprehensive identification of the vehicle through its VIN, year, and make but also includes the registered owner's name, repossession date, and the state where the title is held. By signing this affidavit, the lienholder certifies their legal ownership, the occurrence of default pursuant to the lien’s terms, and the vehicle's repossession within Arizona's jurisdiction. Additionally, it indemnifies the State of Arizona and its employees from liability relying on the affidavit's content. Moreover, the form encompasses a bill of sale section, which is mandatory for the lienholder to complete when selling the repossessed vehicle. This part requires thorough details about the buyer, the sale, and a clear statement regarding the odometer reading to comply with federal and state laws - highlighting the necessity of accuracy to avoid legal penalties. Through this comprehensive affidavit, Arizona provides a structured path for lienholders to navigate the repossession and subsequent sale of vehicles, ensuring that all actions are recorded and lawful.

Document Sample

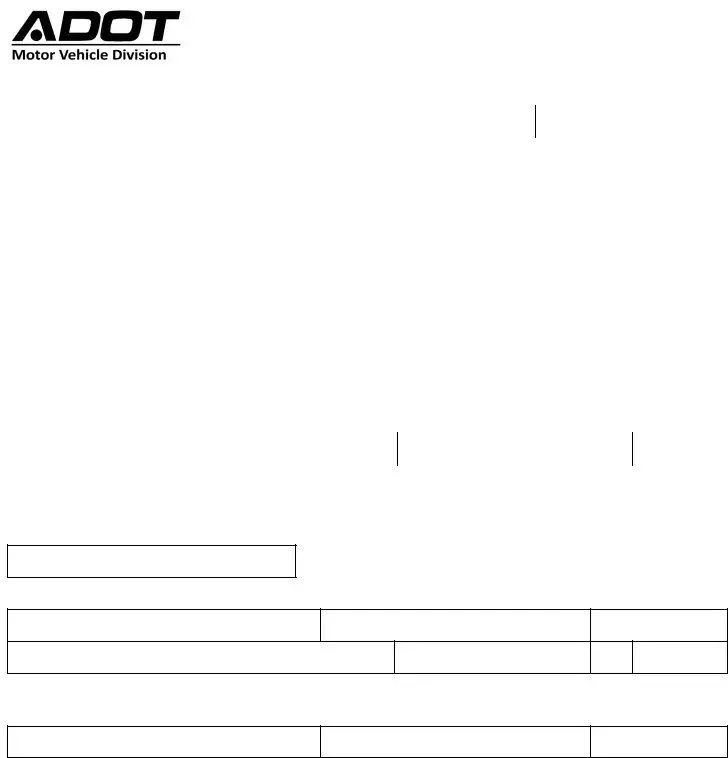

REPOSSESSION AFFIDAVIT

Vehicle Division

www.azdot.gov |

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

Year |

Make |

|

|

|

|

|

I |

|

Registered Owner Names (printed) |

Repossession Date |

Title State |

||

|

|

|

|

I |

I certify that I am the legal owner and a lienholder of record for the vehicle described above, that the vehicle is physically located in Arizona and that I repossessed the vehicle upon default pursuant to the terms of the lien and all applicable laws and regulations, and that the State of Arizona, its agencies, employees and agents shall not be held liable for relying on the contents of this affidavit.

Lienholder Company Name |

|

|

|

|

|

|

|

Lienholder Agent Name |

Lienholder Signature |

|

|

|

I |

|

|

BILL OF SALE |

|

|

|

I hereby sell to the Buyer, the vehicle described above. |

|

|

|

|

|

|

|

Buyer Name |

|

Sale Date |

|

|

|

|

|

Street Address |

City |

State |

Zip |

|

I |

|

I |

Name of New Lienholder (if no lien, write NONE) |

|

Lien Date |

|

|

|

|

|

Federal and State law require that the seller states the mileage in connection with the transfer of ownership. Failure to complete the odometer statement, or providing a false statement, may result in fines and/or imprisonment.

Odometer Reading (no tenths)

miles kilometers

Mileage in excess of the odometer mechanical limits.

NOT Actual Mileage, WARNING – ODOMETER DISCREPANCY.

I certify to the best of my knowledge that the odometer reading is the actual mileage unless one of the boxes above is checked.

Seller Name (printed)

Seller Signature

Date

Street Address

City

State Zip

I am aware of the above odometer certification made by the seller.

Buyer Name (printed)

Buyer Signature

Date

— Sequential Bills Of Sale Will Not Be Accepted —

File Attributes

| Fact Name | Description |

|---|---|

| Governing Law | This form is governed by Arizona state laws and regulations concerning vehicle repossession and title transfer. |

| Purpose | The form is used to legally declare the repossession of a vehicle by a lienholder due to default on payments by the registered owner. |

| Vehicle Information Required | Details such as Vehicle Identification Number (VIN), year, make, and the title state of the vehicle must be provided. |

| Odometer Disclosure | Federal and State laws mandate the seller to state the vehicle's mileage during the transfer of ownership. Penalties apply for failure to comply or falsifying the odometer reading. |

| Bill of Sale Inclusion | The form includes a Bill of Sale section, allowing the lienholder, now the vehicle's legal owner, to record the sale of the repossessed vehicle to a new buyer. |

Guidelines on How to Fill Out Arizona Repossession Affidavit

Filling out the Arizona Repossession Affidavit form is necessary for completing the legal process of repossessing a vehicle. This document serves to officially record the change of ownership due to repossession and ensures that the transaction complies with Arizona law. The steps below guide you through the form so that you can fill it out accurately. It's important to provide complete and precise information to avoid any issues with the vehicle's repossession and sale process.

- Start by writing the Vehicle Identification Number (VIN) in the designated field. This is a unique code used to identify the vehicle.

- Enter the Year the vehicle was made in the next field.

- Fill in the Make of the vehicle, which refers to the brand or manufacturer.

- Under Registered Owner Names, print the name(s) of the vehicle's registered owner(s) as they appear in the official records.

- Specify the Repossession Date, which is the date when the vehicle was repossessed.

- Indicate the Title State, the state in which the vehicle was titled.

- Acknowledge your legal ownership and your role as a lienholder by cert-fying the statement provided. It confirms that the vehicle is located in Arizona and was repossessed according to the law.

- Include the Lienholder Company Name and Lienholder Agent Name to identify the legal entity and individual authorized to repossess the vehicle.

- Sign the form as the lienholder to authenticate it.

- In the bill of sale section, write the Buyer Name who is purchasing the repossessed vehicle.

- Fill out the Sale Date, the day when the vehicle was sold to the new owner.

- Provide the buyer's Street Address, City, State, and Zip code to ensure proper record-keeping.

- If there's a new lienholder, write their name in the Name of New Lienholder field. Write "NONE" if the vehicle will not have a lien against it.

- Enter the Lien Date, if applicable.

- Report the Odometer Reading at the time of sale, choosing between miles or kilometers. Check the appropriate box if the mileage exceeds mechanical limits or if there's an odometer discrepancy.

- Print the seller's name, sign, and date the form to certify that the odometer information is accurate to the best of your knowledge.

- The buyer should also print their name, sign, and date to acknowledge the odometer certification made by the seller.

After completing the form, review all the information to ensure its accuracy. Submitting this affidavit with any errors can lead to legal complications or delays in the vehicle's repossession process. Once everything is in order, submit the form to the appropriate Arizona state agency as directed. This step finalizes the repossession and sale, securely transferring ownership of the vehicle.

Discover More on Arizona Repossession Affidavit

What is a Repossession Affidavit in Arizona?

A Repossession Affidavit in Arizona is a legal document filed by the lienholder (the party who has a financial interest in the vehicle due to a loan or other financial agreement) when they have repossessed a vehicle. This document is essential for verifying that the vehicle has been legally repossessed based on the failure of the borrower to adhere to the terms of the lien. It includes details such as the Vehicle Identification Number (VIN), year, make, and the names of the registered owners, as well as the repossession date. The affidavit serves to inform the State of Arizona that the lienholder has taken possession of the vehicle and intends to sell it to recover the debt owed.

Who needs to fill out the Arizona Repossession Affidavit form?

The lienholder, or legal owner, of the vehicle needs to fill out the Arizona Repossession Affidavit form. This includes providing information about the vehicle, the date of repossession, and the names of the registered owners. Additionally, if the lienholder decides to sell the repossessed vehicle, they also need to complete a Bill of Sale, which is included with the affidavit, providing the buyer's information and the sale details.

What information is required on this form?

The required information on the Arizona Repossession Affidavit includes the Vehicle Identification Number (VIN), the vehicle's year and make, and the printed names of the registered owners. The date of repossession and the state where the title was issued are also necessary. If the vehicle is being sold, details about the buyer, the sale date, and the new lienholder, if applicable, must be provided. The document also requires an odometer reading in miles or kilometers, along with the seller and buyer's signatures acknowledging the odometer certification.

Are there any penalties for not accurately completing the odometer statement?

Yes, federal and state laws mandate the seller to state the vehicle's mileage accurately during ownership transfer. Failing to complete the odometer statement or providing a false statement may lead to severe consequences, including fines and/or imprisonment. It's critical for the seller to certify the odometer reading to the best of their knowledge and indicate if the mileage is in excess of the mechanical limits or if there's an odometer discrepancy.

What happens after submitting the Repossession Affidavit to the Arizona Vehicle Division?

Upon submitting the Repossession Affidavit to the Arizona Vehicle Division, the lienholder's repossession of the vehicle is officially recorded. This allows the lienholder to proceed with selling the vehicle as a way to recoup the owed debt. The affidavit provides legal confirmation that the lienholder has rightful possession and intent to sell, protecting them and future buyers. Additionally, the form facilitates the transfer of the vehicle's title to the new owner, once sold, ensuring all transactions are legally documented and recognized by the state.

What does "Sequential Bills Of Sale Will Not Be Accepted" mean?

This statement on the form means that the Arizona Vehicle Division will not accept multiple bill of sale documents that appear to have been created to artificially extend the chain of ownership or to obscure the true history of the vehicle's ownership. The requirement is aimed at preventing fraudulent transactions and ensuring that each transfer of ownership is transparent and based on a legitimate sale. It underscores the importance of accurately documenting the sale of the vehicle directly from the lienholder to the new owner without intermediate sales.

Common mistakes

When filling out the Arizona Repossession Affidavit form, it's crucial to avoid common errors to ensure the process is completed correctly and without delay. Here are four mistakes people often make:

-

Not verifying vehicle information: It's essential to double-check the vehicle identification number (VIN), year, and make of the vehicle. Incorrect information on the form can lead to processing delays or invalidate the affidavit.

-

Incomplete owner information: Both the registered owner's name(s) and the lienholder's information must be printed clearly. Failing to include complete and accurate information might result in the inability to enforce the repossession legally.

-

Omitting odometer reading details: The federal and state laws require the seller to state the mileage at the time of transfer accurately. Forgetting to fill this section, selecting the wrong unit of measure (miles or kilometers), or marking the incorrect odometer disclosure statement box leads to legal issues or penalties.

-

Skipping signatures and dates: Every section that requires a signature and date must be completed. This includes the lienholder's signature, seller's signature, and buyer's signature, along with the date next to each. Missing any signature or date can invalidate the form or delay the repossession process.

In addition to these specific errors, it's also important to be aware of general mistakes:

Not using the most current form version. The Arizona Department of Transportation periodically updates their forms, including the Repossession Affidavit, and using an outdated form can result in processing delays.

Ignoring sequential bills of sale: The form clearly states that sequential bills of sale will not be accepted. This means each transaction must be documented separately and accurately to be legally valid.

Failing to ensure the vehicle is physically located in Arizona at the time of repossession as required by the affidavit, which could complicate the legal process.

By paying close attention to these details and carefully reviewing the entire affidavit before submission, individuals can avoid common pitfalls and ensure a smoother repossession process.

Documents used along the form

When dealing with the Arizona Repossession Affidavit form, individuals may need to gather additional documents to complete the repossession and sale process effectively. These forms serve various purposes, from validating the repossession to transferring ownership of the vehicle properly. Below is a list of such documents that are often used in conjunction with the Arizona Repossession Affidavit form.

- Loan Agreement: Details the agreement between the borrower and the lender, including the loan amount, interest rate, repayment schedule, and conditions under which the vehicle can be repossessed.

- Notice of Default and Right to Cure: Informs the borrower of the default on the loan and provides them with a final opportunity to rectify the situation before the repossession takes place.

- Repossession Order: Official authorization for the repossession agency to seize the vehicle. This legal document is often required to show to law enforcement or third parties that the repossession is lawful.

- Vehicle Condition Report: A detailed report documenting the condition of the vehicle at the time of repossession, including any damages or modifications. This can be crucial for determining the value of the vehicle and for potential legal protection.

- Odometer Disclosure Statement: Documents the mileage of the vehicle at the time of sale or transfer of ownership, as required by federal and state law. This statement may be part of the Arizona Repossession Affidavit or might be a separate document.

- Power of Attorney: Authorizes a third party, such as a repossession agent or attorney, to make decisions and take actions regarding the repossession and sale of the vehicle on behalf of the lienholder.

- Title or Application for Duplicate Title: In the event the original title is lost or destroyed, a duplicate title application is necessary to transfer ownership to the buyer or new lienholder following the repossession.

Gathering these documents can streamline the repossession process, ensuring all legal requirements are met and the transfer of ownership is executed smoothly. Handling these forms with attention to detail can significantly reduce the risk of legal issues arising from the vehicle's repossession and sale.

Similar forms

The Vehicle Bill of Sale closely mirrors the Arizona Repossession Affidavit form in its core function—transferring ownership of a vehicle. It serves as a formal document between a buyer and a seller to record the sale of a vehicle, stipulating details such as the vehicle identification number (VIN), make, model, and the sale date, similar to the sections found in the Repossession Affidavit. What sets them apart, however, is the context in which they are used; while the Repossession Affidavit implies a legal seizure of the vehicle due to non-payment, a Bill of Sale signifies a mutual agreement of sale.

The Security Agreement is another document similar to the Arizona Repossession Affidavit. This legal document outlines the terms under which personal property is used as collateral for a loan. Like the Repossession Affidavit, it features details about the asset (in this case, a vehicle) and the involved parties. The distinct similarity lies in the identification of the lienholder and the establishment of the lienholder's rights over the property, which is a foundational aspect of the repossession process when the borrower defaults.

A Mechanic's Lien shares commonalities with the Repossession Affidavit due to its focus on securing a lienholder’s interest in a vehicle due to unpaid debt, specifically for repair or maintenance work done on the vehicle. Both documents formalize a lienholder's right to possess or sell the vehicle to recover owed funds. However, while the Repossession Affidavit is utilized following loan default, a Mechanic's Lien is more specific to the auto repair industry.

The Title Application form, essential for establishing or transferring vehicle ownership in most jurisdictions, has similarities with the repossession affidavit, particularly in the details it gathers about the vehicle and its owners. Both require comprehensive vehicle information and owner details to ensure legal compliance and record-keeping. However, the Title Application is broader, often used in a variety of ownership transitions, not limited to repossession scenarios.

Odometer Disclosure Statements are crucial in the sale and transfer of vehicles, much like parts of the Arizona Repossession Affidavit. They ensure transparency in the transaction by certifying the vehicle’s mileage at the time of sale, protecting buyers from potential fraud. While the focus of the Odometer Disclosure is narrower, concentrating solely on the vehicle's mileage, it is a critical element of honest dealings, just as accurate vehicle descriptions are essential in repossession affidavits.

A Conditional Release Form bears similarities to the repossession affidavit, particularly in its function to release parties from certain conditions upon fulfillment of specific criteria. In the context of the Repossession Affidavit, the document might act as a conditional release for the original owner, relinquishing claims to the vehicle once the repossession process is completed under predefined legal terms. This form typically comes into play in various scenarios where conditional agreements are made.

The UCC-1 Financing Statement is a legal document filed to give public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt. This is quite similar to the reposession affidavit's declaration of lien on a vehicle due to default. Both serve to protect the creditor's interest, though the UCC-1 is broader, applicable to various asset types beyond vehicles and used in a wider range of financial transactions.

The Notice of Default and Intent to Sell, which creditors use to inform a debtor about the pending repossession and sale of the property, has clear parallels with the Arizona Repossession Affidavit. This notice is a precursor to the action detailed in the affidavit, setting the stage by officially informing the debtor of their default and the consequences, including a detailed account of the involved property and the amounts due.

A Power of Attorney (POA) for Vehicle Transactions shares certain functionalities with the Arizona Repossession Affidavit, especially in representing the interests of one party in managing the affairs related to a vehicle. Whereas the Repossession Affidavit facilitates the lienholder's legal seizure and potential sale of the vehicle, a POA might be used to grant another person the authority to handle various vehicle-related tasks, including sale, on behalf of the owner. The connection lies in the delegation of rights concerning the vehicle, albeit for different purposes.

Dos and Don'ts

When dealing with the Arizona Repossession Affidavit form, it’s important to take every step with caution and clarity. This document plays a crucial role in the legal process of repossessing a vehicle. To guide you effectively, here's a list of things you should do and things you shouldn't do:

Do:

Verify the accuracy of the Vehicle Identification Number (VIN), year, and make of the vehicle before submitting the form. This ensures the proper identification of the repossessed vehicle.

Print the registered owner's name clearly to avoid any confusion regarding the vehicle's rightful ownership prior to repossession.

Ensure that the date of repossession is entered correctly, reflecting when the vehicle was legally repossessed.

Confirm that the title state listed is accurate according to where the vehicle was originally titled.

Accurately state the mileage on the odometer reading section, choosing the correct unit of measure (miles or kilometers) and noting any discrepancies.

Provide complete and accurate details of the buyer, including name, street address, city, state, and zip code, if the vehicle is sold following repossession.

Fill in the seller's name (printed) and signature with the date of signing, to officially document the transfer of ownership.

Include the name and address of the new lienholder, if applicable, or state 'NONE' if the vehicle is sold without a new lien.

Check the appropriate box regarding odometer accuracy to assure the buyer of the vehicle's condition.

Sign and print the lienholder agent's name clearly to authenticate the repossession and sale of the vehicle.

Don't:

Leave any fields blank. Incomplete forms may cause delays or rejection of the affidavit.

Sign the affidavit before all other relevant sections are filled out. This might invalidate the document or require a new form to be completed.

Forget to check the appropriate box if there’s an odometer discrepancy. Providing false information may result in penalties.

Submit the form without verifying that the vehicle is physically located in Arizona, as this is required for the affidavit to be valid in this state.

Use pencil or any erasable writing tool. All entries should be made in pen to ensure permanency of the information recorded.

Overlook the requirement to note if the mileage exceeds the odometer’s mechanical limits or if it's not the actual mileage, as honesty in this section is critical.

Attempt to submit sequential bills of sale. This practice is not accepted and can complicate the transaction.

Fail to ensure that the buyer acknowledges the odometer certification made by the seller. Both parties should be aware of and agree on the mileage stated.

Ignore state and federal regulations surrounding the sale and repossession of vehicles. Compliance with these rules is crucial.

Assume the form is complete without double-checking every field. An oversight could lead to unintended legal consequences.

Misconceptions

When it comes to the Arizona Repossession Affidavit form, several misconceptions can lead to confusion for both lienholders and vehicle owners. Understanding these misconceptions is crucial for navigating the complexities of vehicle repossession within the state.

Only banks can repossess vehicles: A common misconception is that only banks or major financial institutions have the authority to repossess vehicles. In reality, any lienholder, including private sellers who have retained a lien on the vehicle, can repossess a vehicle if they are the legal owner and the lienholder of record, as long as the vehicle is physically located in Arizona and the repossession is in accordance with the lien and applicable laws.

The affidavit allows for immediate sale of the vehicle: While the Repossession Affidavit form does include a bill of sale, it does not grant the lienholder the immediate right to sell the repossessed vehicle. The lienholder must comply with all state regulations regarding notification and redemption periods before a vehicle can be legally sold.

Repossession can occur without any notification: Many believe that vehicles can be repossessed without any prior notice. Arizona law requires lienholders to adhere to specific rules that often include notifying the borrower before taking possession of the vehicle, except in cases where the repossession is done pursuant to the terms of the lien and applicable laws and regulations.

The form absolves the lienholder of all liabilities: Although the form states that the State of Arizona, its agencies, employees, and agents shall not be held liable for relying on the contents of the affidavit, it does not protect the lienholder from all liabilities, especially if the repossession is found to be unlawful or if the lienholder fails to follow proper legal procedures throughout the repossession and sale process.

Completion of the odometer statement is optional: The affidavit clearly requires the seller (in this case, the lienholder) to state the mileage in connection with the transfer of ownership. Failure to complete this odometer statement, or providing a false statement, can lead to serious legal consequences, including fines and/or imprisonment. This highlights the importance of accurate and truthful completion of all sections of the affidavit.

Sequential bills of sale are permissible: The affidavit explicitly states that "Sequential Bills Of Sale Will Not Be Accepted." This means that the sale process must be direct and transparent, without any intermediate sales that might obscure the vehicle's ownership history or the conditions of its repossession and sale.

Correcting these misconceptions is crucial for ensuring that the repossession process is fair and legal for all parties involved. It’s important for lienholders and vehicle owners in Arizona to be aware of their rights and responsibilities as outlined in the Repossession Affidavit form and related state laws.

Key takeaways

Understanding the Arizona Repossession Affidavit form is crucial for both the legal owner of the vehicle and the buyer. Here are five key takeaways to ensure clarity and compliance through the process:

- Identification and Ownership: The form requires detailed information about the vehicle, including the Vehicle Identification Number (VIN), year, make, and the names of the registered owners. This confirms that the ownership is accurately recorded and recognized by the state.

- Repossession Information: The document must state the date of repossession and affirm that the vehicle is physically located in Arizona. It confirms the legal owner has repossessed the vehicle due to a default under the terms of the lien, in line with state law and regulations.

- Lienholder Responsibility: Completing the form places responsibility on the lienholder to ensure all statements are accurate. The affidavit protects the State of Arizona and its entities from liabilities based on the document's contents, emphasizing the importance of accuracy and truthfulness in the completion process.

- Bill of Sale: The affidavit includes a section for the sale of the repossessed vehicle, requiring the buyer's details and the sale date. It simplifies the transfer process by integrating the sale directly into the repossession documentation, helping to ensure a smoother transition of ownership.

- Odometer Disclosure: Federal and State laws mandate that the seller discloses the vehicle's mileage during the ownership transfer to prevent odometer fraud. Failing to accurately complete this section, or falsifying information, can lead to legal repercussions including fines or imprisonment. This highlights the affidavit's role in maintaining honesty and integrity in vehicle transactions.

These elements are designed to safeguard the interests of all parties and ensure that vehicle repossessions and sales occur transparently and within the boundaries of the law. Anyone involved in such transactions should familiarize themselves with these key points to facilitate a smooth and lawful process.

Popular PDF Forms

Wa State Excise Tax - There’s a section dedicated to exemptions and deductions that could lower the tax obligation.

Peia Tobacco Affidavit - Designed to certify tobacco usage status, this affidavit encourages honest reporting and commitment to cessation programs if needed.